Disclaimer The calculator alone is not sufficient and shouldn't be used for the development or implementation of an investment strategy. This tool is created to explain basic financial / investment related concepts to investors. The tool is created for helping the investor take an informed investment decision and is not an investment process in itself. Bajaj Finserv AMC has tied up with AdvisorKhoj for integrating the calculator to the website. Mutual Fund does not provide guaranteed returns. Also, there is no assurance about the accuracy of the calculator. Past performance may or may not be sustained in future, and the same may not provide a basis for comparison with other investments. Investors are advised to seek professional advice from financial, tax and legal advisor before investing in mutual funds.

Other Calculators

View AllEXPLORE OUR FUNDS

All Mutual Funds

MORE ABOUT WEALTH SIP CALCULATORs

Wealth SIP is an investment facility by Bajaj Finserv AMC that helps investors potentially strengthen their financial future through a one-time application process. The facility combines the benefits of affordable investing through Systematic Investment Plans (SIP) and the convenience of post-retirement steady income generation through Systematic Withdrawal Plans (SWP).

However, determining your investment amount and future monthly withdrawals can be challenging. The Bajaj Finserv Wealth SIP Calculator is a free online tool that makes the process easy for you.

You invest money today to work towards a comfortable life tomorrow. SIPs help you build your corpus through regular instalments. SWPs, on the other hand, allow you to withdraw a fixed amount at regular intervals from your investments. This is especially useful post-retirement, when you don’t have a steady income stream.

However, transitioning from SIPs to SWPs involves several steps. First, you need to start your SIPs. Later, when you need income, you need to initiate the SWP. This might involve moving your funds from high-risk equity schemes to more stable options like hybrid funds.

Wealth SIP will simplify this process, allowing you to initiate your SIPs and future SWPs with a single application. Wealth SIP will be offered for certain pre-determined tenures, ranging from 8 to 30 years.

Investors can choose between Bajaj Finserv Flexi Cap Fund and Bajaj Finserv Large and Mid Cap Fund as their source schemes for SIP investments. At the end of the tenure, units will be automatically transferred to Bajaj Finserv Balanced Advantage Fund – a hybrid mutual fund that invests in equity as well as debt, to combine capital appreciation potential with relative stability. From there, the chosen SWP amount will be transferred monthly.

Do note, however, that returns are not guaranteed, and market risks apply.

This Wealth SIP calculator is an online tool that helps you plan your Wealth SIP strategy.

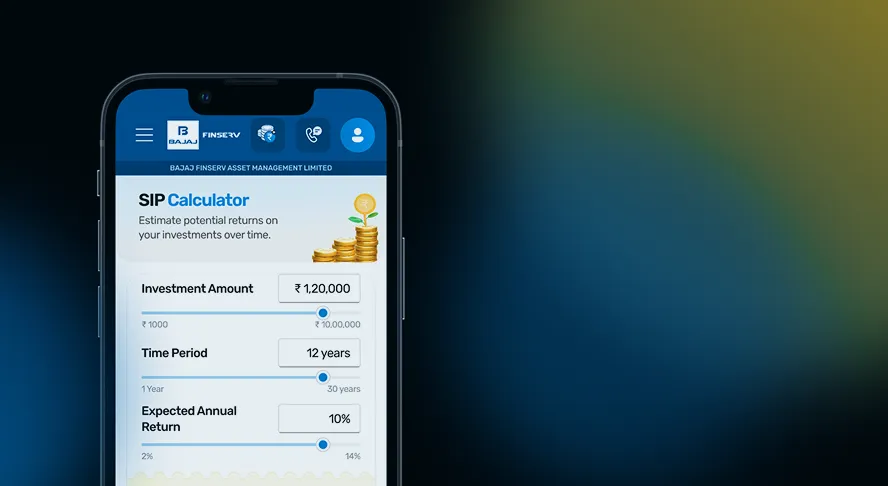

All you need to do is enter your planned monthly SIP amount, expected rate of return (up to 13%) and your monthly SWP withdrawals. Taking into account the potential returns on your SIP investments and your SWP corpus, the calculator tells you your corpus size at the end of your SIP tenure and how many SWP withdrawals you will be able to make.

For this estimate, it will also factor in the potential returns you will earn on your SWP corpus – as you withdraw a certain amount each month, the balance amount in the Bajaj Finserv Balanced Advantage Fund may continue to earn potential returns – to tell you how many withdrawals you can make.

Do note, however, that the calculator’s estimates are based on expected returns and are only illustrative. In reality, returns are not guaranteed, and the rate of return will fluctuate based on market conditions.

- Step 1: Enter the amount you are planning to invest through monthly SIPs.

- Step 2: Enter your SIP tenure. You can choose between tenures of 8 years, 10 years, 12 years, 15 years, 20 years, 25 years and 30 years.

- Step 3: Enter the expected rate of return.

- Step 4: Enter the amount you plan to withdraw every month through SWP.

- Step 5: Check your results.

Ease of use

The tool is user-friendly and free, giving accurate results based on your inputs.

Instant estimates

The algorithm does multiple calculations to give you the results in an instant.

Better planning

You can plan your investment and withdrawal strategy based on clear estimates.

FaQs

Wealth SIP is an upcoming investment facility by Bajaj Finserv AMC that helps combine monthly investment through SIPs and monthly withdrawals through SWPs in a single investment process. Money is automatically transferred from the source scheme to the target scheme at the end of the investment tenure. Then, the SWP begins.

You need to fill out a simple application form to apply, in which you need to choose your SIP tenure, SIP amount and SWP amount. You also need to set up a One Time Mandate between your bank and Bajaj Finserv AMC (if you don’t have an existing mandate with us).

he source schemes (for investments through SIP) where Wealth SIP is applicable are the Bajaj Finserv Flexi Cap Fund and the Bajaj Finserv Large and Mid Cap Fund. The target scheme (for SWP withdrawals) is the Bajaj Finserv Balanced Advantaged Fund.

The output of SIP calculator is accurate but is based on the expected rate of return entered by you. In reality, returns are not guaranteed and depend on market movements.

The minimum investment amount for the Bajaj Finserv Flexi Cap Fund and Bajaj Finserv Large and Mid Cap Fund is Rs 500.

It calculates the future value of your SIP investments using the expected rate of return and investment tenure, considering the power of compounding.

Yes, you can estimate a corpus for retirement and plan systematic withdrawals based on your financial needs.

You need to enter your monthly SIP amount, expected annual return rate, and investment duration.

No, it assumes a fixed return rate and does not account for market volatility or real-time changes.

Yes, you can adjust the investment tenure to see how different timeframes impact your wealth creation.

FUND BASKETS

The calculator alone is not sufficient and shouldn't be used for the development or implementation of an investment strategy. This tool is created to explain basic financial / investment related concepts to investors. The tool is created for helping the investor take an informed investment decision and is not an investment process in itself. Bajaj Finserv AMC has tied up with AdvisorKhoj for integrating the calculator to Read More