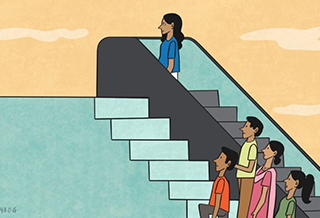

Bajaj Finserv Asset Management Ltd, a wholly owned subsidiary of Bajaj Finserv Ltd, has carved a niche in India’s mutual fund industry as an organisation committed to meaningful innovation.

This rapid growth has helped it surpass the Rs. 20,000-crore AUM milestone as of February 28, 2025. The differentiation reflected in each of its offerings is driven by the three-stage investment philosophy of Bajaj Finserv Asset Management Ltd – InQube – a synergy of informational, quantitative, and behavioural edge.

Innovation and technology are the pillars of Bajaj Finserv Asset Management Ltd in its endeavour to maximise the reach of the Indian mutual fund industry and make wealth creation a possibility for everyone.