Nimesh Chandan has over 24 years of experience in the Indian Capital Markets. He has spent 18 years in Fund Management- managing and advising domestic and international investors, retail as well as institutional. Prior to joining Bajaj Finserv Asset Management Ltd, he has worked with Canara Robeco Asset Management as Head of Investments, Equities (Domestic and Offshore). He has also worked with other asset management companies including Birla Sunlife Asset Management, SBI Asset Management, and ICICI Prudential Asset Management.

{

"url": "/mutual-funds/debt-funds/bajaj-finserv-gilt-fund",

"url_invest": "",

"nav_id": "GFRGG",

"debt": "Debt/Cash 100%",

"equity": "Equity 0%",

"GFRGG": {

"nav": "10000",

"date": "31-10-2024",

"since": {

"bajajflexi": "7.19",

"bajajsmall": "7.33",

"bajajnifty": "7.24"

},

"6_month_ago": {

"bajajflexi": "7.31",

"bajajsmall": "7.43",

"bajajnifty": "7.54"

}

},

"GFDGG": {

"nav": "10001",

"date": "31-10-2024",

"since": {

"bajajflexi": "7.38",

"bajajsmall": "7.33",

"bajajnifty": "7.24"

},

"6_month_ago": {

"bajajflexi": "7.50",

"bajajsmall": "7.43",

"bajajnifty": "7.54"

}

}

}

Category of Scheme

Gilt Fund

Benchmark

CRISIL Dynamic Gilt Index

Min. SIP Amount

₹1000

Inception Date

15-01-2025

Benefits of investing in Bajaj Finserv Gilt Fund

High credit quality

The fund invests in long-term government securities, minimising credit risk.

Reasonable return potential

The fund offers potential for better returns in falling interest rate environments, benefitting from changing market conditions.

Liquidity and stability

The fund offers high liquidity and the potential for relatively stable returns.

Investment Objective

The objective of the Scheme is to generate credit risk-free returns through investments in sovereign securities issued by the Central Government and/or State Government(s) and/or any security unconditionally guaranteed by the Government of India, and/or reverse repos in such securities as per applicable RBI Regulations and Guidelines. The Scheme may also be investing in Reverse repo, Triparty repo on Government securities or treasury bills and/or other similar instruments as may be notified from time to time.

However, there is no assurance that the investment objective of the Scheme will be achieved.

About Bajaj Finserv Gilt Fund

The Bajaj Finserv Gilt Fund is an open-ended debt scheme that invests primarily in government securities across varying maturities, offering relatively low credit risk, since the portfolio is backed by sovereign issuers. Gilt funds aim to generate the potential for reasonable returns by investing in high credit quality government-backed instruments, which may benefit during periods of falling interest rates.

This fund may be suitable for investors seeking minimal credit risk, relative stability, and portfolio diversification. Its objective is to deliver credit risk-free returns through exposure to central and state government securities and related instruments.

Asset Allocation

| Instruments | Indicative allocations (% of total assets) | |

|---|---|---|

| Minimum | Maximum | |

| Government of India Securities/ State Government Securities, Treasury Bills and Cash Management Bills across maturity | 80% | 100% |

| Other Debt Securities and Money Market Instruments* | 0% | 20% |

*Money market instruments will include commercial papers, commercial bills, Triparty REPO, Reverse Repo and equivalent and any other like instruments as specified by SEBI and Reserve Bank of India from time to time.

Who should invest in Bajaj Finserv Gilt Fund?

- Investors seeking an investment avenue with minimal credit risk

- Investors seeking to benefit from falling interest rate environments

- Investors seeking relatively stable return potential over a medium to long term

- Investors seeking portfolio diversification to mitigate risk

Fund Managers

Fund Details

Type of Scheme

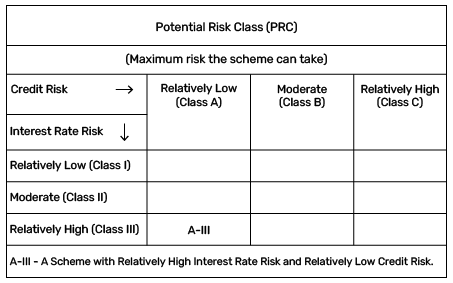

An open ended debt scheme investing in government securities across maturity with relatively high interest rate risk and relatively low credit risk

Minimum Application Amount

- During ongoing offer:

Minimum of Rs. 5,000/- and in multiples of Re. 1/- thereafter - Systematic Investment Plan (SIP) -

Daily SIP: Rs. 1,000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Weekly SIP: Rs. 1,000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Fortnightly SIP: Rs. 1,000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Monthly SIP: Rs. 1,000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Quarterly SIP: Rs. 1,000/- (plus in multiple of Re. 1/-) Minimum installments: 6

Load Structure/Lock-In Period

Entry load - Nil

Exit Load - Nil

The Trustee / AMC reserves the right to change the load structure any time in the future if they so deem fit on a prospective basis. The investor is requested to check the prevailing load structure of the scheme before investing.

Potential Risk Class (PRC)

- The PRC matrix identifies the highest amount of potential risk that a debt mutual fund can assume.

- This regulation was implemented by SEBI on December 1, 2021, making it essential for fund houses to categorize all new and existing schemes under a potential risk class (PRC) matrix.

Product Label and Riskometer

Bajaj Finserv Gilt Fund

An open ended debt scheme investing in government securities across maturity with relatively high interest rate risk and relatively low credit risk

This product is suitable for investors who are seeking*:

- Credit risk free returns over medium to long term

- Investments mainly in government securities of various maturities

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Gilt mutual funds: Overview

A gilt fund is a type of mutual fund that invests chiefly in government securities. These are bonds and debt instruments issued by the government, so they carry virtually no risk of default. Because of this, gilt funds are considered relatively stable investment avenues and carry lower risk than funds investing in corporate bonds. However, their return potential is affected by changes in interest rates. When interest rates fall, the prices of existing bonds rise, leading to better returns for investors. Conversely, when interest rates rise, the market value of existing bonds falls.

Such funds are suitable for investors who want a lower risk avenue, especially during uncertain times in the financial markets. Gilt funds can also help investors earn better returns over the long term if interest rates decrease.

Bajaj Finserv Gilt Fund - Regular & Direct Plans

To invest in the Bajaj Finserv Gilt Fund, you can choose between two plans – regular and direct.

Direct Plan

This plan is suitable for investors who prefer to invest independently without a distributor. Since there are no middle-man costs involved, the expense ratio is also lower. This can have a potential impact on the net returns over time.

Regular Plan

This plan usually involves the investor consulting a registered mutual fund distributor. While it has a slightly higher expense ratio on account of the commission charges involved, the investor also benefits expert guidance throughout the investment duration.

How to invest in Bajaj Finserv Gilt Fund

You can invest in the Bajaj Finserv Gilt Fund either online or offline mode.

- Offline: If you're investing via a distributor, they will help you fill the application form and submit it. If investing directly, you can submit the completed form at the AMC’s Official Point of Acceptance (OPAT).

- Online: Investors can apply through their demat or trading account. Alternatively, log in to the Bajaj Finserv AMC investor portal, set up your account, and invest in a few simple steps.

Taxation on Bajaj Finserv Gilt Fund

The Bajaj Finserv Gilt Fund is taxed as a debt-oriented mutual fund under prevailing income tax rules. For investments made after April 1,2023, all capital gains are deemed to be short-term capital gains and taxed as per the investor’s applicable slab rate. Embed the SIP calculator as we added in SIP Scheme Page

Explore Related Debt Funds

| Overnight Fund | Money Market Fund |

|---|---|

| Liquid Fund | Banking & PSU Fund |

Explore All Schemes

| Equity Funds | Debt Funds | Hybrid Funds | Index Funds |

|---|---|---|---|

| Exchange Traded Fund Funds | Savings Plus | All Mutual Funds |

Frequently Asked Questions

Gilt mutual funds are debt funds that invest primarily in government securities. G-secs typically hold minimal credit risk due to the backing of the sovereign entity. Gilt funds are mandated to allocate a minimum of 80% of their total assets to government securities. These funds aim to offer relatively stable return potential and the potential for steady income.

Gilt funds invest chiefly in government securities, nearly eliminating credit risk as the government is considered a very reliable borrower. Moreover, such benefits can offer capital appreciation potential when interest rates decline, increasing the value of existing fixed-income securities in the secondary market.

The Bajaj Finserv Gilt Fund can be suitable for moderately conservative investors who are seeking reasonable return potential in the medium term, with less volatility than equity funds. It is also suitable for those who want to mitigate credit risk by investing chiefly in government securities. Additionally, it can be a suitable way for investors to diversify their portfolios to add relative stability.

You can invest online via the Bajaj Finserv AMC investor portal, or through digital aggregators and portals. To invest offline, you can submit the scheme application form at the AMC’s official point of acceptance. You can invest independently through the direct plan or through a registered mutual fund distributor through the regular plan.

NAV is updated every business day. For the most accurate and recent value, check the top left of this scheme page.

AUM figures are updated periodically. Please refer to the most recent fund factsheet for latest information.

The fund’s risk classification is disclosed under SEBI’s Riskometer framework. For the current status, refer to the latest fund factsheet.

Holdings vary with market conditions. Please see the latest monthly portfolio disclosure on the AMC’s official site.

The fund primarily invests in government securities. For detailed allocation, view the latest factsheet or scheme information document.

Returns depend on market movements and interest rate cycles. Check the latest fund factsheet for updated performance figures.

There is no mandatory lock-in but exit loads (if any) may apply. Please check the scheme information document for full details.

Expense ratios vary by plan and are subject to revision. Refer to the latest fund factsheet or the AMC website for the current rates.

Learn About Mutual Funds

Posted On: 15 September 2024

Gilt mutual funds, primarily investing in government securities, have long been favoured by risk-averse investors…

Posted On: 28 August 2024

For investors, diversification is key to mitigating risks. Gilt funds are a type of debt…

While equity funds offer the potential for relatively higher returns, they also carry a higher…

Related Video

Mutual Funds For Beginners - Mutual Fund Kya Hai Aur Kaise Kaam Karta Hai

Posted On: 22 Sep 2025

What Is Top Up In Mutual Fund SIP

Posted On: 24 Sep 2025

Common Mistakes Investors Make While Watching The Market Closely

Posted On: 14 Oct 2023