Structure of mutual funds in India

Starting your investment journey requires a good grasp of the intricate structure of mutual funds in India. In fact, for anybody seeking to invest in the financial markets, a thorough understanding of the mutual fund ecosystem is essential.

Most of us have a vague idea that mutual funds are collective investment instruments that pool resources from many investors and deploy them in stocks, bonds, and various other securities. However, a deeper comprehension of this field can enhance any investor’s return potential and help them to make informed financial decisions.

- Table of contents

What is mutual funds structure?

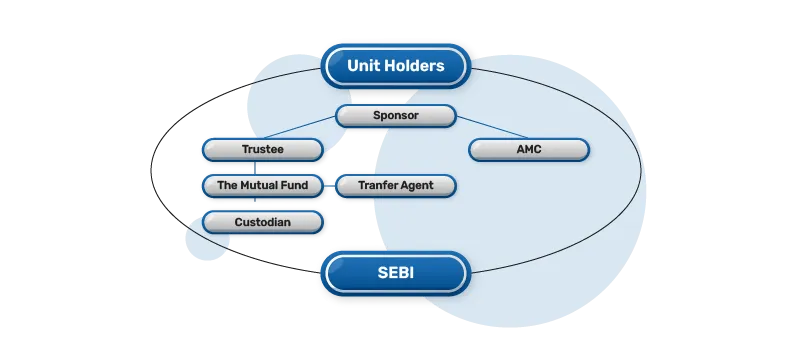

Mutual funds in India follow a well-defined three-tier structure designed to ensure transparency, accountability, and efficient management of investors' money. This structure plays an important role in safeguarding investors' interests and maintaining regulatory compliance.

Structure of Mutual Funds

Going deeper into how mutual funds work and the legal structure of mutual funds, you'll find a three-part structure that forms their foundation.

- Sponsor: At the top is the fund sponsor, who is like the planner of this financial journey. The sponsor starts the fund with SEBI approval, sets its goals and objectives, and plays a big role in its launch. Thus, mutual fund sponsors must have a good understanding of the markets and a smart plan to create wealth through investments.

- Trust and Trustees: Next come the trust and trustees, who are the behind-the-scenes ‘caretakers’ of the fund. The trust is set up to make sure the fund does what's best for the people who invest in it. The trustees have the job of watching over how the fund works and making sure it follows the stipulated guidelines. Thus, we can consider the trustees as vigilant guardians watching over investor interests.

- AMC (Asset Management Company): The third leg of the tripod is the Asset Management Company (AMC). The AMC is the executor and handles day-to-day management of the fund. This includes allocating investors’ money to various securities and asset classes based on the fund's goals and the prevailing market situation. In a nutshell, the AMC's skill in money matters is what keeps a mutual fund on a steady growth trajectory.

To help you visualize the mutual fund structure, consider the fund sponsor as the ‘planner’, the trust and trustees as the ‘guardian’, and the AMC as the ‘expert’. These three together aim to guide a mutual fund scheme to potential success in the markets.

Other Participants in the Structure

- Custodian: Acts like a financial guard for the fund's assets. Their job is crucial in making sure these assets are sheltered from potential risks, giving an extra layer of security to the investment.

- Registrar and Transfer Agent (RTA): Keep detailed records of transactions ensuring accuracy and clarity in tracking investor holdings and smoothening the transaction process.

- Auditor: An unbiased examiner of the fund's financial records, an auditor promotes openness and trust among investors, assuring them that the fund is operating honestly and legally.

- Fund accountants:Calculate the Net Asset Value of the fund on each business day

- Distributors: Registered with the Association of Mutual Funds in India, distributors play a key role in the mutual fund ecosystem. They are an intermediary between the AMC and investors, selling mutual fund schemes to clients.

- KRA: KYC Registration Agencies are SEBI-registered and provides centralised storage of KYC records for the securities market.

Conclusion

In the ever-changing world of building wealth, mutual funds have a crucial role. They act like a roadmap for your money journey, guiding you through the financial waters. The way the fund sponsor, trust and trustees, and the AMC work together forms a strong base for your investment adventure. Custodians, RTAs, auditors, add layers of stability, openness, and efficiency to your investment path. However, it's a good idea to talk to financial advisors or distributors for personalized advice based on your financial goals. This ensures that your journey is well-informed and planned for success.

FAQs:

Why is the role of trustees significant in mutual funds?

Trustees, as custodians of investor interests, play a pivotal role in ensuring the fund's adherence to its stated objectives and regulatory requirements. Their oversight promotes transparency and accountability, instilling investor confidence.

How does a custodian protect the assets of a mutual fund?

The custodian's role goes beyond safekeeping; it involves implementing stringent risk mitigation measures, ensuring compliance with legal requirements, and providing an additional layer of security to the fund's assets.

Why is an auditor essential for mutual funds?

An auditor's independent examination of the fund's financial records is crucial for providing investors with an unbiased assessment of the fund's financial health. This external scrutiny enhances investor trust and confidence in the fund's operations.

How can you invest in mutual funds in India?

You can invest directly through the website of the mutual fund house or asset management company that manages the scheme. You can also invest through a registered mutual fund distributor, a registrar and transfer agent, a bank, or through investment platforms and apps. You can invest a lumpsum amount or through a Systematic Investment Plan (SIP), where you invest regularly over time. If you choose SIPs, an SIP return calculator can help estimate potential returns based on your investment duration and expected rate of return.

What are the three ways mutual funds are structured?

Mutual funds in India come in three primary types: open-ended, closed-ended, and interval funds. Open-ended funds offer high liquidity, allowing continuous issuance and redemption at NAV. Closed-ended funds are open for subscription only during the New Fund Offer period and redeem units only when the fund’s tenure is over. In the interim, you can buy and sell units on listed stock exchanges. Interval funds combine both structures with periodic investment and redemption windows.

What is the governance structure of a mutual fund?

The governance structure of a mutual fund includes three entities: the sponsor, trustee, and asset management company (AMC). The sponsor initiates the fund, the trustee safeguards assets and ensures compliance, and the AMC manages investments and reports performance. This structure ensures transparency, compliance, and protection of investor interests.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

This document should not be treated as an endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purposes only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals, and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on current laws and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.