Siddharth Chaudhary joined the Company in July 2022 as a Head – Fixed Income. Prior to this, he was associated with Sundaram Asset Management Co. Ltd from April 2019 - July 2022 as Head Fixed Income – Institutional Business. From April 2017 – March 2019, he served as a Senior Fund Manager – Fixed Income, and from August 2010 – March 2017 as a Fund Manager – Fixed Income with Sundaram Asset Management Co. Ltd. During June 2006 – September 2010, he was working as Senior Manager, Treasury Dept in Indian Bank.

Bajaj Finserv Nifty 1D Rate Liquid ETF-Growth

ETF

Benchmark:Nifty 1D Rate

| iNAV | ||

|---|---|---|

|

₹ 94.4960

as on 03-Jan-2025 |

|

Total AUM

₹526.53 crores

as on 31 January, 2026Age of Fund

1 Year 9 month

since 28 May, 2024Entry & Exit Load

Nil

Ideal holding period

10 Years+

Investment Objective

The investment objective of scheme is to seek to provide current income, commensurate with low risk while providing a high level of liquidity through a portfolio of tri-party repo on government securities or T-bills/repo amd reverse repo. The scheme will provide returns that before expenses, closely correspond to the returns of Nifty 1D Rate index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Benefits

Low risk

Investments in short-term and high-quality securities mitigate interest rate and credit risk.

Return potential

Offers the potential for slightly better returns than savings accounts.

High liquidity

Traded on stock exchanges, ETFs provide easy buying and selling, ensuring quick and efficient transactions.

Asset Allocation

Tri-Party Repos in Government Securities or Treasury Bills (TREPS): 95% - 100%. Risk Profile - Low

Units of Overnight/ Liquid schemes#, Money Market Instruments (with maturity not exceeding 91 days)*, cash & cash equivalent: 0% - 5%. Risk Profile - Low to Moderate

*Money market instruments will include Government securities, Treasury Bills, Cash Management Bills, CBLO, Repo, Reverse Repo, TREPS, Certificate of Deposits (CDs), Commercial Paper (CPs) and any other securities/instruments as may be permitted by SEBI and RBI from time to time. The Scheme shall make investments in/purchase money market securities with maturity of up to 91 days only.

Investment in repo in corporate debt securities upto 5% of the net asset with maturity of upto 91 days.

#The scheme may invest upto 5% of the net asset in Liquid & Overnight Fund of Bajaj Finserv Mutual Fund and other Mutual Fund without charging any fees, in accordance with the applicable extant SEBI (Mutual Funds) Regulations, 1996 as amended from time to time.

For more details, kindly refer Scheme Information Document.

Top Holdings

Top 7 Stocks

Top Holding

Top 7 Stocks

% to NAV

Clearing Corporation of India Ltd

99.35%

Cash & Cash Equivalent

0.65%

Top 7 Groups

% to NAV

CCIL

99.35%

Cash & Cash Equivalent

0.65%

Top 4 Sectors

Others

99.35%

Cash & Cash Equivalent

0.65%

As on 31-01-2026

Top Holdings

Others

94.80%

Government of India

0.66%

Cash & Cash Equivalent

0.93%

Instrument break-up

TREPS

1.75%

As on 31-01-2026

Launch Date

May 28th, 2024

Load Structure/Lock-In Period

Entry load – not applicable

Exit load – Nil

There will be no exit load for units sold through the secondary market on the stock exchange. Investors shall note that the brokerage on sales of the units of the scheme on the stock exchanges shall be borne by the investors.

Minimum Application Amount

On an On-going Basis:

On Exchange: Investors can buy/sell units of the scheme in round lot of 1 unit and in multiples thereof.

Directly with the Mutual Fund: Any order placed for redemption or subscription directly with the AMC must be of greater than Rs. 25 Cr. However, the aforementioned threshold of INR 25 crore shall not apply to investors falling under the following categories (until such time as may be specified by SEBI/AMFI):

• Schemes managed by Employee Provident Fund Organisation, India;

• Recognised Provident Funds, approved Gratuity funds and approved superannuation funds under Income Tax Act, 1961.

On Exchange: Investors can buy/sell units of the scheme in round lot of 1 unit and in multiples thereof.

Directly with the Mutual Fund: Any order placed for redemption or subscription directly with the AMC must be of greater than Rs. 25 Cr. However, the aforementioned threshold of INR 25 crore shall not apply to investors falling under the following categories (until such time as may be specified by SEBI/AMFI):

• Schemes managed by Employee Provident Fund Organisation, India;

• Recognised Provident Funds, approved Gratuity funds and approved superannuation funds under Income Tax Act, 1961.

Fund Size (AUM)

- Monthly Average - 526.53 as as on 31 January 2026

- Month End - nil - 578.86 as on 31 January 2026

Benchmark Index

Nifty 1D Rate Index

Market makers

- East India Securities Ltd

- IIFL Securities Limited

Total Expense Ratio of Mutual Fund scheme

Maximum Total expenses ratio (TER) permissible under Regulation 52 (6) (c) - Up to 1.00 and additional expenses for gross new inflows from specified cities - Up to 0.30

Fund Managers

Fund Details

Type of scheme

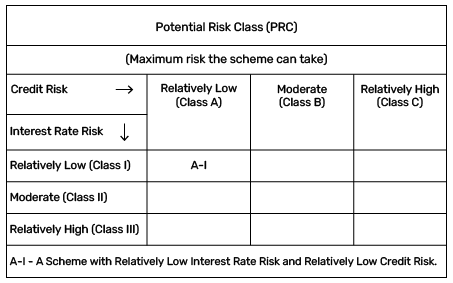

Bajaj Finserv Nifty 1D Rate Liquid ETF - Growth - An open ended Exchange Traded Fund tracking Nifty 1D Rate Index with Relatively Low Interest Rate Risk and Relatively Low Credit Risk

Potential Risk Class (PRC)

Product Label and Riskometer

This product is suitable for investors who are seeking*:

- Short term savings solution

- An open ended Exchange Traded Fund liquid scheme, that aims to provide returns by investing in securities covered by Nifty 1D Rate Index with low risk and a high level of liquidity, subject to tracking error.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Principles of incentive structure for market makers

The broad principles on which the AMC would determine the compensation would include the trading volume, generating liquidity in the market, bid-ask spread in units of ETFs, expense ratio of the ETFs and such other information as may be required to formalize performance based incentive structure.

Overview

The Bajaj Finserv Nifty 1D Rate Liquid ETF is an exchange traded fund that invests in short-term debt instruments. These include Tri-party repos in government securities or treasury bills, units of overnight and liquid schemes, money market instruments (maturity not exceeding 91 days) and cash and cash equivalents. It aims to provide returns that mirror the Nifty 1D Rate Index, subject to tracking error.

Offering high liquidity, this ETF can be suitable for those looking for a short-term investment solution that offers better return potential than savings accounts, albeit with some market risk. Investors need a demat account to invest.

What are ETFs

ETFs, or Exchange-Traded Funds, are diversified investment avenues that trade on stock exchanges like individual stocks. Similar to mutual funds, ETF investments offer diversification by holding a variety of stocks, bonds, or commodities.

However, unlike mutual funds, ETFs can be bought and sold throughout the trading day at the price quoted on exchange, which is based on the current value of their underlying securities. Moreover, with most mutual funds, a manager actively chooses the portfolio holdings and makes buy or sell decisions based on the investment strategy and objectives. The goal is usually to outperform the broader market. In comparison, ETFs mirror an existing stock market index (such as the Nifty 50) and seek to replicate its performance (subject to a tracking error, which is the difference between the fund’s performance and that of its benchmark).

Why invest in ETFs?

Here are some of the benefits of investing in ETFs:

- Diversification: ETFs provide exposure to a broad range of assets, helping reduce individual stock or sector risk.

- Low costs: ETFs generally have lower fees than actively managed funds, keeping more of your returns.

- Flexibility: You can buy and sell ETFs anytime during market hours, just like stocks.

Who should invest

ETF investments can be suitable for a diverse range of investors. This can include:

1. New investors who seek exposure to various assets through a single investment.

2. Seasoned investors seeking portfolio diversification or the inclusion of specific asset classes.

3. Investors who want to reduce the role of a fund manager’s decision-making on their investment and prefer to align it with broader market movements.

4. Investors seeking intra-day liquidity and trading flexibility.

5. Investors who want lower expense ratios than that charged by active mutual funds

Explore Related Exchange-Traded Funds

| Nifty 50 ETF | Nifty Bank ETF |

|---|

Other Mutual Fund Types

| Equity Funds | Debt Funds | Hybrid Funds | Index Funds |

|---|---|---|---|

| Exchange Traded Fund Funds | Savings Plus | All Mutual Funds |

Frequently Asked Questions

The Nifty 1D Rate Liquid ETF invests in short-term debt securities such as TREPS, overnight securities and other fixed-income instruments with high liquidity and low risk.

This ETF can be suitable for investors looking for a low-risk, highly liquid option to park surplus cash for short durations. It offers the potential for better returns than savings account, albeit with some risk.

While the risk level is low, no mutual fund or ETF is risk free and returns may fluctuate depending on market conditions.

Investors need a demat account to invest in this fund.

Learn About Mutual Funds

Posted On: 23 February 2024

New investors can often be daunted by the enormous variety of mutual fund schemes to…

Exchange-Traded Funds (ETFs) have emerged as popular investment vehicles for both seasoned and new investors.…

Posted On: 23 August 2024

While ETFs are categorised under the broad bucket of mutual funds, there are some key…

Related Video

Be Future-Ready With Megatrends | Bajaj Finserv Flexi Cap Fund

Posted On: 30 Aug 2023

Benefit From Megatrends With Bajaj Finserv Flexi Cap Fund

Posted On: 30 Aug 2023

Long-Term Megatrends Investing with Bajaj Finserv Flexi Cap Fund

Posted On: 30 Aug 2023