Exploring The Myths Related To Overnight Funds

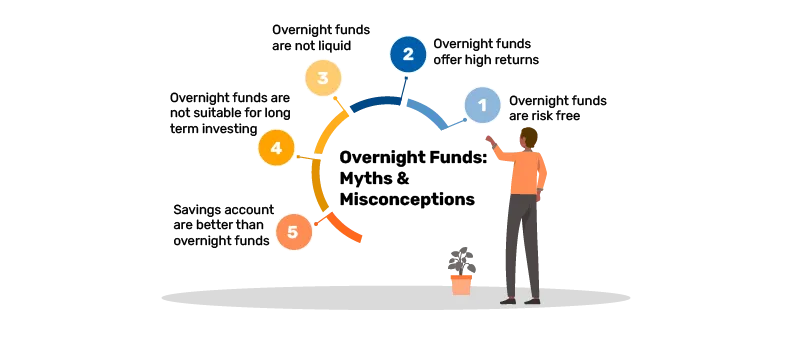

Overnight funds are often preferred by investors who prioritise liquidity and less impact on capital. However, there are several myths and misconceptions surrounding these funds that may deter investors from fully utilising their potential benefits. In this article, we will explore the common myths about overnight funds and provide insights into the reality behind them.

- Table of contents

- Myth 1: Overnight funds are risk free

- Myth 2: Overnight funds offer high returns

- Myth 3: Overnight funds are not liquid

- Myth 4: Overnight funds are not suitable for long term investing

- Myth 5: Savings account are better than overnight funds

Myth 1: Overnight funds are risk free

One of the most common myths about overnight funds is that they are risk-free. Many investors believe that since overnight funds invest in short-term instruments with a maturity of just 1 day, they are not subject to market volatility and are therefore totally risk-free. However, this is not entirely accurate. While it is true that overnight funds invest in instruments that are generally considered to be low-risk, there is still some risk associated with these funds.

For example, although they mature the very next day, these funds are still subject to interest rate risk. If interest rates rise, the value of existing securities with lower coupon rates may decrease, leading to a temporary decline in the net asset value (NAV) of the fund. Additionally, there is still a small degree of credit risk and default associated with these securities.

Myth 2: Overnight funds offer high returns

One of the most common overnight fund myths is that they offer a high return potential. Many investors believe that since overnight funds invest in short-term market-linked instruments, they should provide higher returns than traditional savings accounts. However, this is not always the case. Overnight funds are structured to provide liquidity and mitigate any impact on capital invested, rather than generate a high return potential. While they may offer slightly higher return potential than traditional savings accounts, they are not designed to be a high-return investment vehicle.

Myth 3: Overnight funds are not liquid

Some investors believe that overnight funds are not liquid, meaning that they cannot be easily converted into cash. This is not true. Overnight funds are designed to provide high liquidity, and they typically offer same-day or next-day settlement. This means that investors can quickly and easily convert their investment into cash if needed.

Read Also: Overnight debt mutual funds

Myth 4: Overnight funds are not suitable for long term investing

Overnight funds are not exactly designed with long-term investing in mind. However, these funds can still play a key role in your overall long-term investment portfolio. For instance, you can use overnight funds as a temporary parking place for surplus cash that you intend to invest long-term in the near future. Also, since overnight funds are highly liquid, you can deploy them as an emergency fund for quick access to cash when required.

Myth 5: Savings account are better than overnight funds

Finally, some investors believe that savings accounts are better than overnight funds. While savings accounts can be a suitable option for saving money, they are not necessarily better than overnight funds. Overnight funds can be the better option for earning marginally higher potential returns while parking your money for the short term and enjoying high liquidity. Thus, depending on the individual circumstances, overnight funds can be considered over traditional savings accounts in some cases. However, unlike savings accounts, returns from overnight funds are not guaranteed and subject to market risks.

For example, the Bajaj Finserv Overnight Fund is designed to cater to investors seeking a reasonable return potential with relatively low risk and high liquidity. The fund's primary focus is to invest in overnight securities with a maturity of just one business day, ensuring quick access to funds. As an open-ended debt scheme, it aims to offer relative stability and low interest rate risk and credit risk.

Conclusion

Overnight funds can be a suitable investment option for investors who seek less impact on capital and maintain liquidity. However, there are several overnight fund investment myths that may deter investors from fully utilising their benefits. By understanding the reality behind these myths, investors can make informed decisions about whether overnight funds are right for their portfolio. Overnight funds offer high liquidity, but for wealth creation over the long term, consider equity mutual funds. An SIP interest calculator can help you estimate potential returns on your investments.

Read Also: Overnight Funds: The Relationship Between Liquidity and Performance

FAQs:

Are overnight funds really risk-free?

No, overnight funds are not risk-free. While they invest in low-risk instruments, there are still some risks associated with these funds, such as credit risk and negligible interest rate risk.

Do overnight funds offer high returns?

No, overnight funds are not designed to offer high returns. They are designed to provide liquidity and low impact on capital.

Are overnight funds liquid?

Yes, overnight funds are designed to provide liquidity by the next business day. Plus Overnight Fund also has insta-redemption facility. This means that investors can quickly and easily convert their investment into cash if needed.

What are the common myths about overnight funds?

A common myth is that overnight funds offer high returns. In reality, while they may offer slightly higher return potential than traditional savings accounts, they are not designed to be a high-return investment vehicle. Another myth is that overnight funds are completely risk-free. Though low risk, they are still subject to standard market risks, credit risk, interest rate risk and reinvestment risk. A third myth is overnight funds are not liquid. These funds are designed to be highly liquid and some mutual fund companies also offer instant redemption on overnight funds.

Are overnight funds completely risk-free?

No, overnight funds are not risk-free. While they invest in very short-term debt instruments, credit risk and interest rate risk, though minimal, can still exist. Moreover, returns are not guaranteed and depend upon market conditions. However, they are considered low risk compared to other debt fund categories.

Who should invest in overnight funds?

Overnight funds can be suitable for investors seeking a low-risk avenue for parking surplus funds for short durations. They are often used for liquidity management and can be beneficial for those looking for a slightly better return potential on their surplus funds compared to a savings account.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.