Navigating the investment landscape can be overwhelming, especially when your goals loom closer on the horizon. Money market funds (MMFs) offer a relatively stable and accessible option for parking your cash and earning some potential return in the meantime. Whether you're saving for an upcoming travel adventure, building an emergency fund, or preparing for a down payment, money market funds can provide the relative stability and liquidity that many other investment options lack.

But before taking the plunge, let's explore how to invest in money market funds for short term. We also discuss some ideas to invest in money market funds and aim to make the most of your short-term investments.

- Factors to consider before investing in money market funds

- Tips for investing in money market funds for short term

Factors to consider before investing in money market funds

Factors to consider before investing in money market funds

Investment horizon: The relatively low volatility and short-term maturities of money market fund makes them suitable for shorter time horizons.

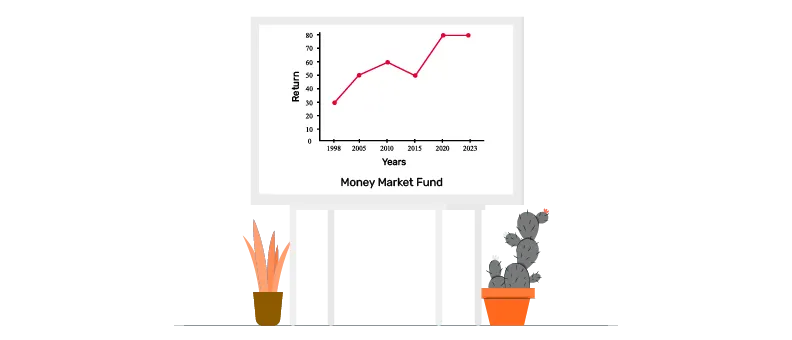

Returns: While higher than a basic savings account, MMFs don't provide extravagant returns. Also, unlike savings account, the returns are not guaranteed and depend upon market conditions.

Liquidity: You can withdraw your funds at any time without penalty, offering peace of mind for unexpected expenses.

Expenses:MMFs typically have low expense ratios, but comparisons are still useful. Lower expenses can translate to relatively better net returns, so scrutinise them carefully.

Taxation: Interest and capital appreciation from MMFs is taxable in India. Factor this into your calculations to understand your actual returns.

The Bajaj Finserv Money Market Fund offered by Bajaj Finserv Asset Management Limited can be an option for investors seeking moderate returns and low/moderate risk over short-term periods. This open-ended debt scheme prioritises liquidity, allowing you to access your money quickly. While aiming for regular income through money market instruments, remember that success is not guaranteed. Choose this option if you seek low-to-moderate risk and high liquidity for short-term financial goals. For a detailed scheme information, click here.

Tips for investing in money market funds for short term

Start small, diversify well: Allocate only a portion of your savings to MMFs. Diversifying your portfolio across different asset classes helps manage risk and potentially achieve long-term goals.

Ladder your investments: Invest in MMFs with varying maturity dates, like three, six, and nine months, to ensure staggered access to funds as needed. This provides flexibility and avoids last-minute scrambles.

Embrace the digital advantage: Many online platforms offer lower minimum investments and user-friendly features like automated investing and portfolio tracking. Technology can simplify your investment journey.

Seek professional guidance: If unsure about specific choices, consult a qualified financial advisor. They can personalise recommendations based on your unique needs and risk tolerance.

Conclusion

When used strategically, money market funds can be invaluable partners in your short-term financial journey. Remember, responsible investing is key. Consider MMFs that align with your investment objectives, allowing your money to work for you. With diligent research, smart strategies, and a touch of professional guidance, you can leverage the power of MMFs to achieve your short-term financial goals.

FAQS:

What are money market funds, and how do they work?

Money market funds invest in short-term debt instruments like treasury bills and commercial paper. They aim to provide liquidity and relatively stable returns by investing in low-risk, short-maturity securities. Like any mutual fund, these funds are also subject to market risks.

Are money market funds a suitable investment for short-term goals?

Money market funds can be suitable for short-term goals, offering potentially better returns than savings accounts. However, unlike savings account, these funds don’t offer guaranteed returns. Market fluctuations can impact returns. Consider your risk tolerance and investment horizon.

How do money market fund returns compare to savings accounts?

Money market funds typically offer potentially higher returns than savings accounts due to investments in market-linked instruments. However, returns are subject to market risks and are not guaranteed, unlike savings accounts.

What are the risks associated with investing in money market funds?

Money market funds carry some risks, including credit risk (the issuer may default) and interest rate risk (fluctuations in interest rates can impact returns). Though considered relatively low-risk, they are not risk-free.

How can I choose a suitable money market fund for my investment needs?

Consider factors like expense ratios, fund manager experience, historical performance, and the fund's investment strategy. Align the fund's objectives with your financial goals and risk tolerance. Past performance is not indicative of future results.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.