Pure Equity vs Asset Allocation— Which is Better?

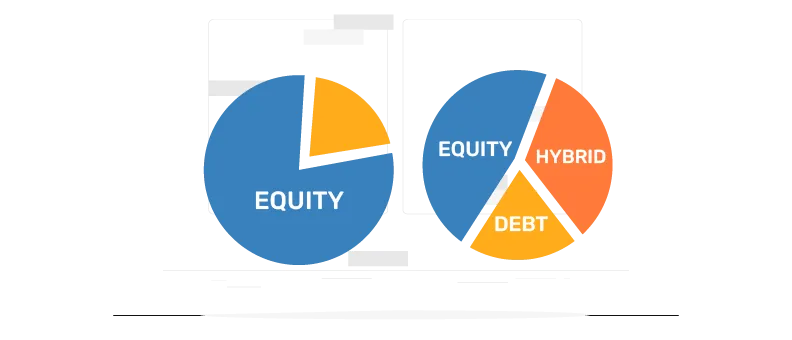

Choosing between equity mutual funds and hybrid mutual funds may be challenging, especially for new investors. Equity mutual funds invest predominantly in company stocks and have the potential to offer relatively high returns over time but have significant accompanying risks. On the other hand, hybrid mutual funds that invest in both equity and debt follow a more balanced approach to investing, where returns may not be as high but there could be better risk mitigation during market volatility.

Let’s understand in detail the difference between pure equity vs asset allocation funds.

- Table of contents

- Understanding pure equity

- Understanding asset allocation

- Difference between pure equity and asset allocation funds

- Equity vs diversified asset allocation: How to choose

Understanding pure equity

The term ‘pure equity’ refers to investments solely in equities. In the context of mutual funds, an equity mutual fund may not be strictly pure equity, but it invests predominantly in equity and equity-related instruments. Such funds entail higher risk than funds that follow a hybrid strategy.

The decision to choose an equity mutual fund must align with an investor’s risk tolerance. Investment horizon and goals are other key considerations – equity mutual funds may be suitable if you have a long horizon that allows your portfolio to ride out short-term swings in the market.

Understanding asset allocation

The term ‘asset allocation’ describes the diversification of one's financial resources across several investment vehicles, including equity, debt, gold, real estate etc. Managing and mitigating investment risk and optimising the return potential across market cycles are the main goals of asset allocation.

In the context of mutual funds, asset allocation is a strategy followed by several schemes categorised as hybrid funds by SEBI.

The portfolio mix usually includes assets with lower risk and lower return potential (like government bonds) as well as assets with potentially higher pay-outs and higher risks (like stocks).

Funds that follow a diversified asset allocation pattern include:

1. Conservative Hybrid Fund: Invests up to 25% of its assets in equity and the rest in debt.

2. Balanced Hybrid Fund: Invests between 40% and 60% in debt as well as equity.

3. Aggressive Hybrid Fund: Invests up to 80% in equity and the rest in debt.

4. Dynamic Asset Allocation Fund: Dynamically managed investment in debt and equity

5. Multi Asset Allocation Fund: Invests in at least three asset classes.

6. Equity savings: Invests in equity, debt and arbitrage opportunities.

Read Also: Equity funds vs. multi asset fund: Understanding the difference

Difference between pure equity and asset allocation funds

Equity mutual funds and asset allocation funds differ in their investment strategies, asset allocations, and risk profiles. Here are the key differences between the two:

|

|

Pure Equity Funds |

Asset Allocation Funds |

|

Objective and asset allocation |

Invests in stocks or equities with the objective of potentially generating capital appreciation over the long term. |

Invest across different asset classes such as stocks, bonds, cash, and sometimes alternative investments like real estate or commodities. The objective is to potentially balance risk and return based on the fund's stated investment strategy – a conservative fund may be more stability-oriented, while an aggressive hybrid fund may be more return-oriented.

|

|

Risk profile |

Relatively higher risk profile compared to asset allocation funds because of the volatility of the equity market.

|

These funds offer a more balanced risk profile due to their diversification across asset classes. By spreading investments across different types of assets, they aim to mitigate the overall portfolio risk. |

|

Return potential |

Offer a relatively higher return potential over the long term, especially during bull markets or periods of strong economic growth. |

Such funds may offer relatively more stability and consistency of returns across market cycles due to diversification across asset classes.

|

|

Who should invest |

Investors with a very high risk tolerance and a long-term investment horizon who are comfortable with higher levels of volatility in exchange for potentially higher returns.

|

Investors with a relatively high risk tolerance who desire a potentially more stable investment experience. |

Equity vs diversified asset allocation: How to choose

When constructing an investment portfolio, the optimal balance between equity and debt depends on several factors:

- Risk appetite: High risk investors may find pure equity funds favourable for their high return potential over the long term. Investors who want a more optimum risk-reward balance may find a diversified fund more suitable. Conservative investors may prefer more debt than equity in their portfolio.

- Age: Younger investors with a longer investment horizon and a high risk appetite may opt for a pure equity fund. As you move closer to your retirement age, you should shift towards a more diversified portfolio and become more conservative when you have nearly reached your goal.

- Investment horizon: If you have a medium-term goal, a pure equity fund may not be suitable. For longer-term goals, both equity and equity-oriented hybrid funds can be considered.

- Market conditions: Funds with a diversified asset allocation can provide downside protection in uncertain markets.

Read Also: What Are Multi-Asset Allocation Funds and How Do They Work?

Conclusion

Although equity mutual funds offer potentially better returns, they come with more risk and volatility. On the other hand, mutual funds with diversified asset allocation provide a balanced approach, potentially mitigating volatility and offering better peace of mind during market downturns. However, investors should consider their risk tolerance, investment objectives, and time horizon when choosing between the two types of funds.

FAQs

Which investment strategy is more suitable for long-term growth?

Equity investments have historically shown a higher return potential over the long term than hybrid funds, but investors need to be comfortable with a high degree of risk to invest in equity. Hybrid funds with a higher equity component may also be suitable for long-term potential wealth creation, albeit with more risk-mitigation mechanisms than equity funds. Conservative hybrid funds may be more suitable for shorter investment horizons or for risk-averse investors.

Can pure equity or asset allocation help in reducing investment risk?

Asset allocation funds seek to mitigate investment risk by diversifying across asset classes such as stocks, bonds, and real estate. However, they still entail relatively high risk because of their equity component.

How do I decide between pure equity and asset allocation funds?

By evaluating your risk tolerance, investment objectives and time horizon, you can decide which approach is more suitable for you. You can also take the help of mutual fund tools such as a monthly SIP calculator. The calculator helps you see the potential returns on your investment based on your investment amount, tenure and expected returns. This can help you assess the difference in return potential of a pure equity scheme and a hybrid scheme and accordingly choose one that aligns with your goals. Do note, however, that higher return potential typically comes with higher risk.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.