How to build a diversified portfolio with mutual funds?

Calculated risks can open new horizons in life. But when it comes to investing your hard-earned money, it's important to carefully evaluate all risks. After all, today’s planning is better than tomorrow’s regret. So, if you're interested in investing in mutual funds but concerned about market risks, one way to reduce your risk exposure is by building a well-diversified portfolio. Here, we’ have outlined few strategies to help you build a diversified mutual fund portfolio that can withstand market ups and downs. But first, let’s understand what mutual fund portfolio diversification is.

- Table of contents

- What is portfolio diversification in mutual funds?

- 6 crucial things to remember before investing in mutual funds

- Different ways to diversify your mutual fund portfolio

- Avoid over-diversification in mutual funds

- Diversify investment across equity, debt, and hybrid mutual funds

What is portfolio diversification in mutual funds?

Mutual fund diversification, also known as asset allocation, is an investment strategy that can help in managing market risks by spreading investments across multiple sectors regardless of the size or market capitalization. This approach aims to generate long-term capital growth by diversifying investments, which can help deliver better returns even during challenging market conditions.

Read Also: Mutual Fund Portfolio Overlap - How to Avoid It

6 crucial things to remember before investing in mutual funds

1. Define your investment goals

Clarify your objectives: Identify what you're saving for, such as retirement, a home, or your child’s education.

Account for your time frame: Short-term goals (less than 5 years) might require safer investments, while long-term goals (10+ years) can accommodate higher risk strategies.

2. Understand your risk tolerance

Evaluate your comfort with risk: Assess how comfortable you are with potential market ups and downs. Can you accept short-term losses for long-term potential growth?

Adaptability of risk tolerance: Your risk preferences may evolve based on factors like age, financial stability, and life stage.

3. Choose an appropriate fund category

Equity funds: Higher risk but potential for greater returns, suitable for long-term goals and investors with higher risk tolerance. Examples: large-cap, mid-cap, and small-cap funds.

Debt funds: Lower risk with modest returns, suitable for short-term goals or conservative investors. Examples: liquid funds, short-term funds, and income funds.

Hybrid funds: Combining equity and debt, these funds balance risk and returns.

4. Review fund performance and expense ratios

Past performance isn’t predictive: Historical returns can guide you, but they don’t guarantee future outcomes.

Prioritize expense ratios: Lower ratios mean more of your money works for you. Compare funds within similar categories for cost efficiency.

5. Diversify your portfolio

Spread your investments: Allocate funds across different asset classes (like equity, debt, and gold) and fund managers to reduce overall risk.

6. Start early and stay committed

Benefit from compounding: Consistent, long-term investing can enhance growth potential. Avoid trying to predict market highs and lows.

Different ways to diversify your mutual fund portfolio?

-

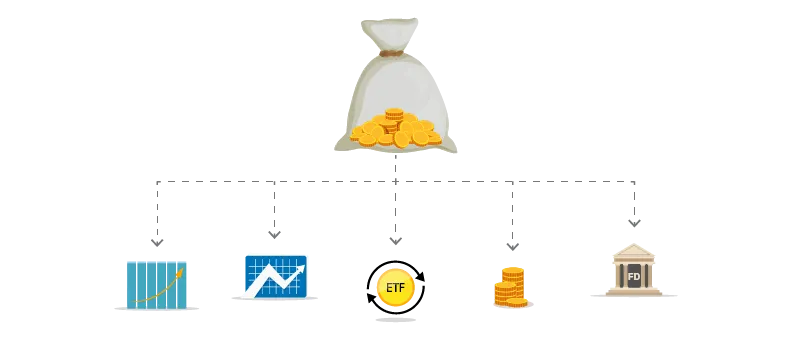

To strengthen your portfolio, you must opt4 for funds/schemes that invest in different securities with different risk levels such as stocks, bonds, commodities, etc. Spreading the risk is essential because in case one investment suffers, others may do better and help balance out the overall performance of your portfolio.

-

Industry diversification can also help you diversify your mutual fund portfolio in India. By investing across a range of industries, you can mitigate the impact of industry-specific risks. You must research different sectors and choose your investments carefully.

-

You can also rely on the expertise of your fund manager. A skilled fund manager will know when and where to invest, thereby balancing risks to help you achieve your financial goals. Using a mutual fund compound interest calculator is also helpful in estimating the potential growth of your investments over time.

-

Diversification is a powerful tool for investors looking to build a robust and successful mutual fund portfolio. So don't be afraid to explore new investment opportunities and remember to always keep an eye on risk management.

Avoid over-diversification in mutual funds

-

Diversifying your mutual fund portfolio is like adding some spice to your investment game - it's a good idea to sprinkle a little here and there. But just like adding too much spice can ruin a good dish, over-diversifying your portfolio can have some potential side effects.

-

While it’s true that adding a new fund to your portfolio may help reduce your risk, it can also affect your gains. Simply put, with too many funds, you might not lose much, but you won't gain much either.

-

Also, the more diversified your portfolio, the tougher it is to monitor and manage it. This can be a little overwhelming in the long run. In conclusion, building a mutual fund portfolio is all about finding the right balance.

Read Also: How to Avoid Over-Diversification of Your Portfolio

Diversify investment across equity, debt and hybrid mutual funds

Depending upon your risk appetite, time horizon, and investment objective, you can consider diversifying your investment across equity, debt & hybrid mutual funds. Let’s have a brief look at each of them.

Equity mutual funds

Also known as growth funds, equity funds are mutual fund schemes that invest their assets predominantly in shares/stocks of different companies based on the investment objective of the underlying scheme. In case of equity funds, the returns depend on the market performance; hence, these funds carry high levels of risk.

Debt mutual funds

Debt funds or bond funds are mutual funds that invest in various debt securities and money market instruments that generate fixed income such as treasury bills, commercial papers, bonds, etc. In case of debt funds, the returns are usually less impacted by market fluctuations as compared to equity funds; hence, these funds are relatively less risky than equity funds.

Hybrid mutual funds

Commonly known as asset allocation funds, hybrid funds are a type of mutual fund that invest in more than one asset class i.e., equity, debt, etc. It offers the investors a diversified portfolio, thereby providing them an option to invest in multiple asset classes through a single fund. These funds offer varying levels of risk tolerance from conservative to moderate and aggressive.

Now that you have a fair understanding of the type of mutual fund schemes, you must carefully evaluate your investment goals and risk appetite and choose your investment option wisely. For instance, if you have a high risk appetite, you can consider investing in equity mutual funds. Whereas, if you’re a conservative investor with a low risk appetite, then debt mutual funds may serve the purpose for you. And finally, if you are a moderate investor, willing to take a slightly elevated risk, then hybrid funds may be the one for you. Diversifying your portfolio in a balanced way across different asset classes can help you obtain better returns whilst minimizing market risks.

FAQs

What are the most important benefits of portfolio diversification?

Some of the important benefits of portfolio diversification are enlisted below:

● Can reduce the impact of market volatility.

● Helps in creating long-term wealth.

● Reduces the effort and time required in portfolio management.

How many mutual funds are good in a portfolio?

While portfolio diversification can help you spread the market risk, you must note that investing in every mutual fund category will not offer you the best return or diversification. In case you are investing in a small amount, you need not invest in numerous schemes.

What are the things to consider for building a diversified portfolio?

You must take into consideration your risk appetite, investment goals and investment horizon for building a diversified mutual fund portfolio.

What is the 75-5-10 rule for diversified funds?

The 75-5-10 rule ensures mutual funds remain diversified. Funds must allocate at least 75% of assets to other issuers, limit investments in a single company to 5%, and hold no more than 10% of a company’s voting stock. This rule minimizes concentration risks, offering greater safety for investors.

Why is diversification important in mutual fund investments?

Diversification is vital in mutual fund investing as it reduces unsystematic risk, smooths market volatility, and enhances return potential by spreading investments across companies, sectors, and asset classes. It fosters stability and peace of mind during market fluctuations. Achieve diversification through asset, sector, geographic, and investment style allocations, aligned with financial goals.

How can I diversify my mutual fund portfolio effectively?

To build a diversified portfolio, focus on asset allocation by spreading investments across equities, debt, gold, and real estate. Diversify within asset classes, considering large-cap, mid-cap, and small-cap equity funds, and different types of debt funds. Consider emerging market investments, review your portfolio annually, and consult with a financial advisor for personalized strategies.

What are the benefits of diversifying across equity, debt, and hybrid funds?

Diversifying across equity, debt, and hybrid funds helps reduce risk, enhance returns, and improve stability. Equity funds offer growth, debt funds provide stability, and hybrid funds balance both. Tailor your allocation based on risk tolerance and investment goals. Regularly review and rebalance your portfolio with professional advice to maintain the desired mix.

Can over-diversification impact my mutual fund returns?

Over-diversification can negatively affect mutual fund returns by diminishing benefits, diluting returns, and increasing costs. Spreading investments across too many funds may lead to underperformance and added complexity in managing the portfolio. Finding the right balance, based on risk tolerance and goals, is key for optimal returns.

Related Searches:

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.