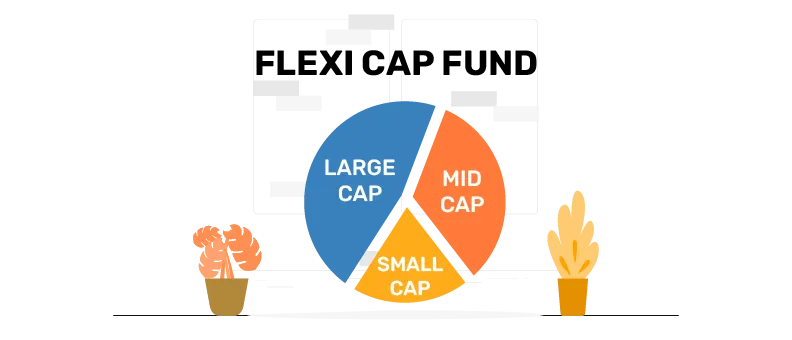

A flexi cap mutual fund invests in stocks of companies across market capitalizations – large cap, mid cap and small cap. This can help the fund potentially leverage the growth opportunities offered by small and mid cap companies while benefiting from the relative stability of large cap companies.

There is no minimum allocation required in each market capitalization, so the fund manager is free to plan the flexi cap fund investment portfolio as per their growth strategy, market knowledge and insights.

Moreover, the fund manager can dynamically alter the allocation strategy for the flexi cap fund investment based on prevailing market trends. This can potentially help the fund mitigate downside risk or capitalize on segments that are performing well.

Investors who seek long-term capital appreciation and have a high risk-appetite can potentially invest in flexi cap funds. You can invest in Bajaj Finserv Flexi Cap Fund either in lumpsum or through SIP, depending on your financial goals and investment strategy.

Bajaj Finserv Flexi Cap Fund - Regular and Direct Plans

When you invest in any mutual fund, including the Bajaj Finserv Flexi Cap Fund, you have two plans: Direct Plan and Regular Plan.

-

Direct Plan: You invest directly with the Bajaj Finserv AMC, without involving any intermediaries or distributors. As a result, there’s no commission or distribution fee involved, which means the expense ratio is lower and your potential returns could be slightly higher over the long term.

-

Regular Plan: This option involves a distributor who helps you with the investment. The mutual fund company pays a commission to the distributor, which is included in the plan’s expense ratio. That’s why regular plans usually have slightly higher costs compared to direct plans.

In short, the main difference is how you invest – on your own (Direct) or with the help of an distributor (Regular) and this affects the cost and returns.

How to invest in Bajaj Finserv Flexi Cap Fund

You can invest in Bajaj Finserv Flexi Cap Fund both offline and online, directly through Bajaj Finserv Asset Management Ltd or through registered mutual fund distributors or aggregator platforms.

To invest online, you can click on the log in/register button on the home page. You can also click on ‘Invest Now’ on this scheme page.

On the investor portal, you can log in with your PAN details or sign up. You can then invest through a quick, straightforward and 100% digital journey.

To invest offline, you can fill out an application form and submit it at any official point of acceptance (OPAT) of the AMC.

Taxation on Bajaj Finserv Flexi Cap Fund

Bajaj Finserv Flexi Cap Fund follows equity mutual fund taxation. The capital gains from Bajaj Finserv Flexi Cap Fund are taxed based on how long you’ve held the investment.

-

Short-term capital gains (STCG):

If you sell your mutual fund units within 12 months from the date of allotment, the gains are treated as short-term. These are taxed at 20%, plus any applicable surcharge and cess.

-

Long-term capital gains (LTCG):

If you sell the units after holding them for more than 12 months, the gains are considered long-term. In this case, gains up to Rs. 1.25 lakh in a financial year are tax-free. Any amount above that is taxed at 12.5%, plus surcharge and cess as applicable.

Explore Related Equity Funds

Other Mutual Fund Types