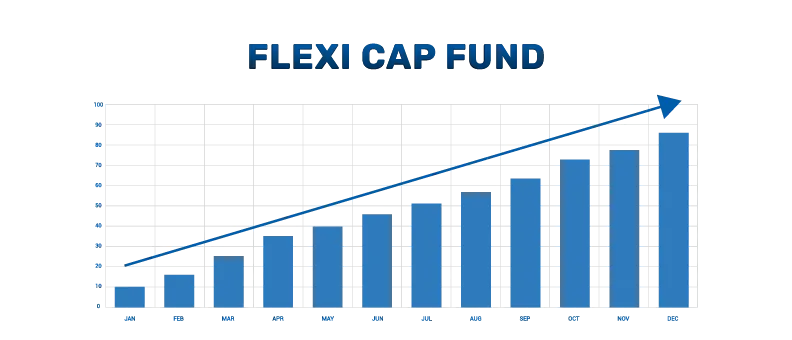

Emerging markets present numerous opportunities for investors seeking high growth potential. Within this dynamic landscape, flexi cap funds emerge as a versatile investment option, offering investors the flexibility to potentially capitalise on the diverse opportunities that emerging markets offer.

This article explores the growth potential of flexi cap fund in emerging markets, examining how this fund can leverage the unique characteristics of these markets to deliver an attractive return potential for investors.

- Growth potential in emerging markets

- How flexi cap fund can leverage emerging markets

Growth potential in emerging markets

Emerging markets are countries with diverse economies that are growing quickly. They have more young people entering the workforce and their industries are expanding rapidly. Hence, emerging markets tend to grow faster than developed countries because of factors like increasing disposable income, favourable government policies, advancements in technology, etc. As these countries keep developing, they offer suitable investment avenues across themes such as technology, healthcare, and finance.

However, it's crucial to acknowledge the inherent risks while talking about emerging markets. These markets can be relatively more volatile than developed economies due to factors like political instability, currency fluctuations, and less-developed infrastructure. For investors, this implies the necessity of a longer investment horizon and a relatively higher risk appetite.

How flexi cap fund can leverage emerging markets

Flexi cap funds have the flexibility to invest across market capitalisations without being constrained by predefined allocation limits. This dynamic investment approach allows fund managers to adapt to changing market conditions and potentially capitalise on emerging opportunities across different sectors and geographies.

In the context of emerging markets, flexi cap fund offer several potential advantages:

- Diversification: Emerging markets may offer sectoral and geographic diversification, allowing flexi cap fund to access a broad range of investment opportunities. By investing in companies across various sectors and regions, these funds can spread risk and potentially mitigate the impact of market-specific volatility.

- Opportunistic allocation: Flexi cap funds have the flexibility to allocate capital dynamically based on prevailing market conditions and investment prospects. In emerging markets, where rapid changes and structural shifts are common, this ability to adapt allows fund managers to seize attractive opportunities and optimise the portfolio’s risk/return profile.

- Active management: Flexi cap funds are actively managed, enabling fund managers to conduct in-depth research and analysis to identify promising investment avenues within emerging markets. Through active stock selection and portfolio rebalancing, managers aim to capitalise on mispriced assets and potential growth catalysts, enhancing overall portfolio performance.

- Risk management: While emerging markets offer significant growth potential, they also entail higher risks associated with volatility, currency fluctuations, and geopolitical factors. Flexi cap funds employ risk management strategies to mitigate these risks, such as hedging currency exposure, diversifying across asset classes, and implementing stringent investment criteria.

Read Also: Understanding the market risks in mutual fund investments

Flexi cap funds represent a dynamic investment proposition for investors seeking exposure to the growth potential of emerging markets. With their flexible investment approach and active management style, these funds are well-positioned to capitalise on the diverse opportunities and evolving dynamics within emerging economies. Flexi cap funds offer investors the potential for attractive returns while effectively managing risks through diversification and active risk management strategies. However, it is always prudent to consult a financial advisor for advice before making any investment decisions.

FAQs:

Why choose Bajaj Finserv Flexi Cap Fund?

The Bajaj Finserv Flexi Cap Fund adopts a strategic megatrend investing approach, targeting long-term growth potential by investing in companies well- positioned to capitalise on significant global trends. These megatrends encompass high-growth sectors like digitisation, technological advancements, healthcare, consumerism, and urbanisation.

How to choose a suitable flexi Funds?

When selecting a flexi cap fund, investors should consider factors such as the fund's investment objectives, track record, fund manager's expertise, expense ratio, and risk management practices. Furthermore, investors should assess their own risk tolerance, investment horizon, and portfolio diversification needs to ensure alignment with their financial goals and objectives.

How are flexi-cap mutual funds taxed?

Taxation of flexi cap mutual funds is similar to other equity-oriented mutual funds. Short-term capital gains (if the units are held for less than one year) are taxed at a rate of 15%. Meanwhile, long-term capital gains (if the units are held for more than one year) are taxed at 10% without indexation beyond the Rs. 1 lakh annual exemption limit.

Can an investor redeem investment in flexi cap mutual funds anytime?

Yes, investors can typically redeem their investments in flexi cap mutual funds at any time, subject to the fund's redemption policies and any applicable exit load charges. Flexi cap funds offer liquidity similar to other open-ended mutual funds, allowing investors to buy or sell units on any business day at the prevailing NAV.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.