How to reach your future goal with mutual funds?

Every goal requires a plan, and this holds true for your financial aspirations as well. Creating a meticulous plan for your financial goals can help you identify the resources you have at your disposal to achieve them. Investing in mutual funds can take you a step closer to your financial goals. Mutual funds are investment vehicles that pool money from multiple investors to invest in securities such as stocks, bonds, or other securities.

Before we take you through how mutual funds can help you achieve your financial goals, let’s have a quick look at how you can plan your financial goals in three simple steps:

- Table of contents

- How to plan financial goals?

- How to use mutual funds to achieve financial goals?

- How to use a goal planner?

How to plan financial goals?

- Be specific: The first thing is to clearly define your financial goal, whether it is to go on a foreign trip this summer, build an emergency fund in 6 months, buy a luxury car in 3 years, or save Rs.1 crore in 10 years. Be as specific as possible with exact numbers, if possible.

- Create an action plan: Create an action plan with details on how much you need to save and invest to reach your goal. Start with defining your budget, how much you can realistically save each month and what part of it you would invest in mutual funds or other instruments of investment towards your goals.

- Prioritize debt repayment: In case you have any outstanding debt, you must prioritize repaying it as part of your financial planning. Also, high interest debt, such as credit card should be repaid first to minimize the interest outgo.

- Build a financial cushion: While planning for your financial goals, you must also work towards building an emergency fund that can safeguard you in case of unexpected events such as job loss or medical bills. Your emergency fund should be sizeable enough to cover at least 3-6 months of your living expenses.

- Use tools: If you are investing in mutual funds, a goal planner can be an invaluable tool. It will enable you to see what kind of returns you can expect from your investment, the future value of your money and so on. This will help you identify concrete steps to follow to meet your goal. Also, you must review and adjust your plan regularly so that it’s aligned with your financial goals and circumstances.

How to use mutual funds to achieve financial goals?

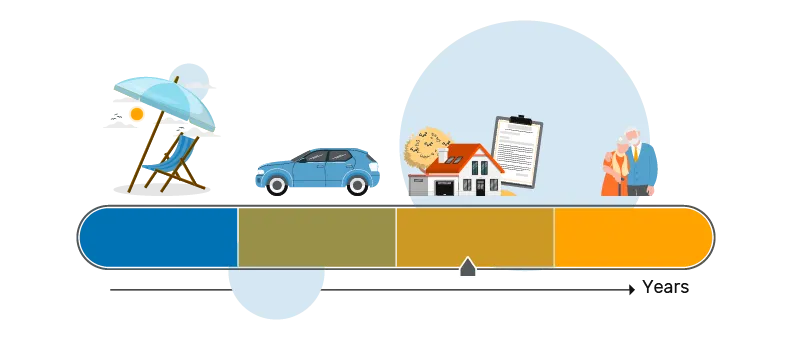

Irrespective of what your financial goals are, mutual funds can offer reasonable returns on investment and help you achieve them in the following ways:

- Retirement planning: This is a long-term investment goal that you can achieve by investing in equity and equity-based mutual funds. While equity funds are considered high-risk investments, the long investment horizon provides long term growth thanks to the power of compounding and rupee-cost averaging.

- Buying a car: This is a relatively short-term financial goal that can work well when paired with a debt fund. These are low-risk funds that seek to offer reasonable returns on investment. Hybrid funds are also suitable since they offer the relative stability of debt funds and the return quotient offered by equity.

- Saving for a vacation: Liquid funds and short-duration debt funds could work well for this short-term financial goal. The key is to not take unnecessary risks since market movements can affect your returns.

- Tax savings: Claim a tax deduction of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act by investing in the Equity Linked Savings Scheme (ELSS). You can invest in such mutual funds with a lock-in period of 3 years to meet your financial goals.

How to use a goal planner?

If you want to plan your financial goal with mutual funds, then this is how you should use the goal planner:

Step 1: Select your goal: The first step is to choose your financial goal in the goal planner. Your goal can range from saving for a vacation to building a retirement corpus and everything in between, such as funding your child’s education, buying a home, or creating wealth.

Step 2: Choose the time horizon of your goal: Your goal must have an end date. It will give you a clear timeframe. Choose the number of years in which you want to achieve your goal.

Step 3: Determine the present value of your goal: Decide what your goal is worth in exact monetary terms right now. If wealth creation is your financial goal, then you still need to define exactly how much money you want to have

Step 4: Estimate the inflation rate: Most people do not understand the concept of the time value of money. They fail to realise that any sum of money is worth more today than it will be in the future because of inflation. Choose the expected inflation rate to see the estimated future value of your goal. The goal planner will also give you an idea of how much you need to invest to achieve your goal

Conclusion:

Once you know how to plan for your financial goals, you must use a goal planner. It helps you get a fair idea about the future value of your goal and the money you need to invest in mutual funds to reach your financial targets. You can create a step-by-step action plan for each financial goal with the help of a goal planner.

FAQs:

How do you write a financial goal plan?

Start by identifying your short-term and long-term financial goals. Then, create a budget to prioritize your expenses and develop a savings plan. Regularly review and adjust your plan as your financial goals and circumstances change. You can consult a financial advisor or mutual fund distributor to plan your financial goals.

What is the goal of a financial plan?

The goal of financial planning is to create a roadmap for achieving your financial objectives. This includes evaluating your current financial situation, identifying your financial goals, and developing a plan to reach those goals.

How can mutual funds help in achieving financial goals?

Mutual funds can be a suitable investment vehicle for achieving various financial goals, from long-term goals such as retirement planning and children's education to short or medium-term objectives. They offer diversification and professional management, potentially helping investors grow their wealth over time. However, it's crucial to align fund selection with specific goals and risk tolerance.

Which type of mutual fund is suitable for long-term financial goals?

Equity mutual funds are generally considered suitable for long-term financial goals due to their potential for capital appreciation over time. However, they also carry higher risk. A diversified portfolio including debt funds can be considered to manage risk.

Can I use mutual funds for short-term goals like buying a car?

Equity funds are usually not suitable for short-term goals because of the volatility and unpredictability of the financial market. For shorter timelines, debt funds may be more suitable and may offer slightly better return potential than other traditional savings avenues. However, though they are lower risk than equities, they are not risk free.

How does a goal planner help in financial planning?

A goal planner helps in financial planning by defining specific financial objectives (e.g., retirement, education), estimating the required corpus, and suggesting investment strategies. It helps visualize the path to achieving goals and monitor progress, enabling informed financial decisions.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.