What is the Role of Commodities in Multi-Asset Allocation Funds?

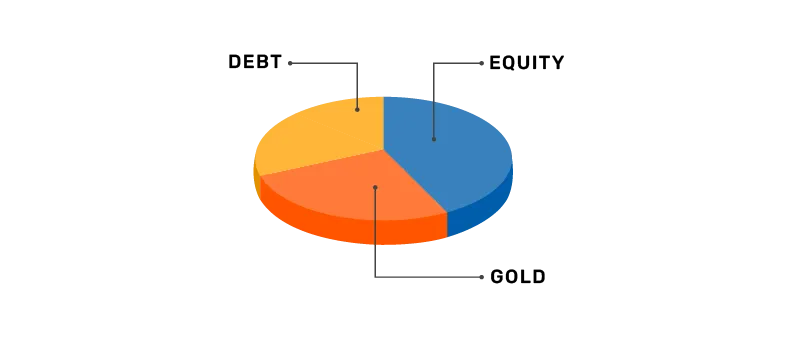

A multi-asset allocation fund is an open-ended mutual fund that invests in at least three asset classes – such as equity, debt, commodities etc – each of which typically responds differently to market trends. Fund managers can also adjust the allocation ratio dynamically in response to market movements and their insights. This can help such funds optimise return potential, mitigate risk and leverage different market scenarios.

While the equity portion of the portfolio provides growth potential, the debt component lends relative stability to the investment, especially in volatile times. The remaining asset classes in the portfolio – which often include commodities, exchange-traded commodity derivatives or REITs/InVITs – can also play an important role in mitigating risk and generating reasonable return potential. This article focuses on the role of commodities in multi asset allocation funds.

- Table of contents

- What Are Commodities in Multi-Asset Allocation Funds?

- How multi-asset allocation funds invest in commodities

- Importance of commodities in multi-asset allocation fund

- Types of Commodities Typically Included in Multi-Asset Funds

- Strategies for Investing in Commodities within Multi-Asset Funds

- How to Choose a Multi-Asset Fund with Commodities Exposure

What are commodities in multi-asset allocation funds?

Commodities in multi-asset allocation funds typically involve investments in raw materials such as:

Metals: Examples include gold, silver, and copper.

Energy: Investments may include crude oil and natural gas.

Agriculture: These cover grains, livestock, and similar commodities.

Methods of inclusion:

Commodity ETFs: Funds that replicate the performance of a specific commodity or group of commodities.

Futures contracts: Agreements to trade a commodity at a predetermined price on a set future date.

How Multi-Asset Allocation Funds Invest in Commodities

Many multi-asset allocation funds invest in commodities through gold and silver exchange-traded ETFs These can play an important role in enhancing portfolio diversification and hedging against market volatility and economic uncertainty. Additionally, some commodities are considered safe-haven assets, which have long-term value and are typically less affected by economic downturns than volatile avenues such as equities. They can even potentially offer growth opportunities during turbulent times.

Importance of Commodities in Multi-Asset Allocation Fund

Commodities can play the following roles in a multi-asset allocation fund portfolio:

- Inflation hedge: Commodities such as gold and silver can potentially be an effective hedge against inflation. As inflation increases, the value of these metals may also rise. This can make them valuable during periods of high inflation.

- Volatility hedge: Commodities, such as gold and silver, may play a vital role in a multi-asset allocation fund by serving as a hedge against stock market volatility. When the stock market is unstable, commodities can potentially retain their value or not fall as drastically as equities. Metals such as gold and silver also emerge as safe haven investments during volatile times – given their historical significance and relative stability, investors flock to these avenues during uncertain times. This can help increase portfolio stability and potentially mitigate the impact of equity market downturns.

- Upside potential: Commodities such as gold and silver can offer growth potential, optimising overall portfolio returns.

- Low correlation with equities: Commodities usually have a low correlation with traditional asset classes such as equities. This implies that there is not much similarity in the price movements of gold and equities – one does better when the other falls. Incorporating commodities into a multi-asset allocation fund can therefore help leverage market situations where equities are underperforming.

Types of commodities typically included in multi-asset funds

Multi-asset allocation funds typically include a range of commodities to enhance diversification and potential returns. Some common types are: energy (crude oil, natural gas); metals (gold, silver, copper); agriculture (grains, livestock, and softs)

The specific commodities included can vary depending on the fund's objectives and the manager's strategy.

Strategies for investing in commodities within multi-asset funds

Diversification:

Broad commodity exposure: Invest in a range of commodities, such as energy, metals, and agriculture, to reduce dependency on price fluctuations of any single commodity.

Asset class diversification: Keep commodities as a small, yet significant, part of a diversified portfolio, alongside stocks, bonds, and possibly real estate.

Risk management:

Tactical allocation: Adjust commodity exposure based on market conditions, economic forecasts, and inflation expectations. For example, increase exposure during periods of high inflation or economic instability.

Consider derivatives: Use futures contracts or options to hedge against potential price declines in specific commodities.

Long-term perspective:

Commodities can be volatile in the short term. Hold a long-term investment horizon to weather market fluctuations and potentially benefit from long-term growth trends.

Fund selection:

Choose experienced fund managers: Opt for fund managers with a proven track record in managing commodity investments.

Consider fund objectives: Select funds that align with your investment goals and risk tolerance.

How to choose a multi-asset fund with commodities exposure

1. Define your investment objectives and risk tolerance:

Investment goals: Determine if you seek capital appreciation, income generation, or a balance of both.

Risk tolerance: Assess your comfort with market fluctuations, as commodities can be volatile.

2. Understand the fund's investment strategy:

Asset allocation: Ensure the fund’s asset allocation aligns with your risk tolerance.

Commodity exposure: Identify the specific commodities included and their weight in the portfolio.

Investment approach: Understand whether the fund manager takes an active or passive approach.

3. Evaluate the fund manager's expertise:

Track record: Review the manager's historical performance and experience with commodity investments.

Investment philosophy: Ensure the manager’s investment philosophy matches your own.

4. Consider fund performance and costs:

Historical performance: Analyze past performance, but note it’s not an indicator of future results.

Expense ratio: Compare expense ratios, as lower costs can improve long-term returns.

5. Diversification and risk management:

Diversification: Evaluate diversification across sectors, regions, and asset classes.

Risk management: Understand the fund’s strategies to manage risk, like hedging or dynamic asset allocation.

6. Read the scheme information document (SID):

The SID provides detailed information on the fund, including its objectives, risks, and expenses.

Conclusion

Commodities play a crucial role in multi-asset allocation funds by enhancing diversification and a cushion against some market risks. Gold and silver, through ETFs, can serve as hedges against inflation and market volatility. Their low correlation to traditional asset classes can help lend relatively stability – and even upside potential – during market downturns. A multi-asset allocation fund with commodities can give investors a balanced investment avenue with some resilience to unfavourable market conditions.

FAQs

What are commodities in the context of multi-asset allocation funds?

Commodities in multi-asset allocation funds can comprise investments in gold ETFs or silver ETFs. These assets can diversify a portfolio and offer a hedge against market volatility, optimising the risk-return balance in a portfolio.

How do commodities help in hedging against inflation in multi-asset allocation funds?

Commodities such as gold and silver have historically emerged as a hedge against inflation because their value tends to increase as prices in the economy go up. This helps mitigate impact on the purchasing power of the investment.

How do commodities improve returns in multi-asset funds?

Commodities can potentially enhance multi-asset funds through diversification, serving as a hedge against inflation and a volatility buffer. They provide potential for better returns, especially during economic growth or rising inflation. However, commodities are volatile, and careful selection and allocation are vital to managing risk and optimizing returns.

Can commodities help during market volatility?

Commodities can offer protection during market volatility through low correlation with stocks and serving as an inflation hedge. However, commodity prices can be volatile, influenced by factors like supply-demand imbalances and geopolitical risks. Their effectiveness as a hedge varies, so careful consideration is needed before adding them to a portfolio.

What is the role of gold in multi-asset allocation funds?

Gold enhances diversification in multi-asset funds by having low correlation with stocks and bonds. It acts as an inflation hedge, preserves purchasing power, and serves as a safe-haven asset during times of economic uncertainty. However, gold prices can be volatile, and careful allocation is necessary to match investment goals.

What are the benefits of adding commodities to a multi-asset fund portfolio?

Adding commodities to a multi-asset fund offers enhanced diversification, acting as a hedge against inflation and market volatility. Commodities, especially precious metals like gold, help preserve purchasing power and provide a buffer during market downturns. However, careful selection and allocation are essential to balance risks and returns in the portfolio.

Can commodities in multi-asset funds help mitigate impact of stock market downturns?

Commodities can potentially mitigate impact of stock market downturns by offering low correlation with stock prices and acting as an inflation hedge. However, they can be volatile, and their effectiveness as a hedge depends on the specific commodity and market conditions. Careful selection and portfolio allocation are important to balancing risks.

How often should I use an mutual fund SIP calculator?

Use an mutual fund SIP calculator whenever you start a new SIP, change investment goals, or want to review your portfolio.

Is there a way to automatically increase my SIPs in multi asset funds over time?

Yes, a step up SIP allows you to increase your contributions by a fixed rate at regular intervals (such as 10% annually). A step up SIP calculator can help you plan your investment approach.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.