Large and Mid-Cap Mutual Funds – Tax Implications You Should Know

Large and mid-cap funds are gaining traction among Indian investors due their mix of relative stability and long-term growth potential. However, like all mutual funds, they come with certain tax implications. Understanding these is important for any investor looking to potentially build wealth over time through large and mid cap funds, because taxes can reduce net gains over time.

This article discusses the tax implications of large and mid-cap funds in India and offers insights into how investors can optimise their tax outgo.

- Table of contents

- Mutual fund taxation in India – Understanding

- Large and mid-cap mutual funds – Capital gains tax

- Holding period and its impact on tax liability

- Large and mid-cap funds – Taxation of IDCW

- Indexation benefit: Does it apply?

- How to calculate tax on mutual fund gains

- Tax-saving strategies while investing in mutual funds

- Comparing tax implications: Large vs mid cap funds

- Documentation and reporting for mutual fund taxation

Mutual fund taxation in India – Understanding

To understand the tax structure, it’s important to learn the following terms:

Capital gains

Capital gains are the profits earned if you sell mutual fund units at a higher price than the purchase price.

Income Distribution cum Capital Withdrawal (IDCW) payouts

A portion of the mutual fund’s distributable surplus can be potentially distributed to investors as income. This is only applicable to investors who opt for the IDCW plan (instead of the growth plan, where all potential gains are reinvested).

Holding period

The duration for which you hold the mutual fund units affects the tax you pay on capital gains for some fund categories. Longer holding periods attract relatively lower taxes. Indian tax laws promote long-term investing by offering reduced tax liabilities for longer holdings.

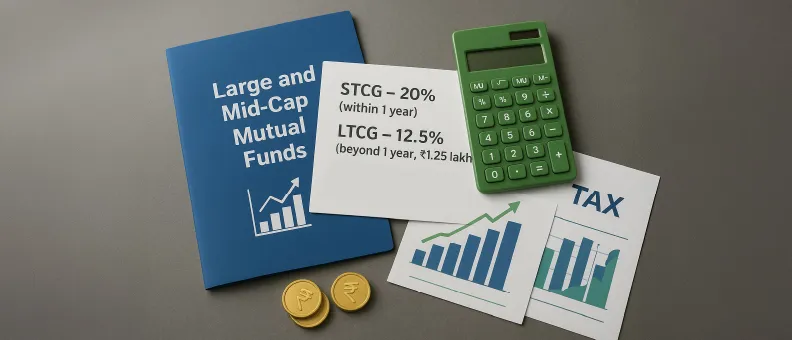

Large and mid-cap mutual funds – Capital gains tax

Funds that invest more than 65% in domestic equities are considered equity-oriented funds for taxation purposes. Large and mid cap funds fall into this category.

Gains arising from sale of large and mid-cap fund units after they are held for more than 12 months, are treated as long term capital gains (LTCG). These are taxed at the rate of 12.5% above the Rs. 1.25 lakh exemption limit in a financial year.

If units are sold before 12 months, the gains are considered short term capital gains (STCG) and taxed at tax 20%.

While these are the latest taxation rules for equity funds, consulting a tax

advisor for tailored investment solutions can help one in optimising one’s tax outgo.

Read Also: Detailed Guide: How to Claim Tax Benefits on Mutual Funds (ELSS)?

Holding period and its impact on tax liability

The holding period directly affects whether the capital gain is categorised as long-term or short-term, and hence impacts the applicable tax rate. As mentioned above, a holding period of at least one year is required for the potential profits from your investment to qualify as long-term capital gains. Since the LTCG rate is considerably lower than the STCG rate, holding your large and mid-cap fund investments for more than a year can reduce your tax outgo.

This also aligns with broader financial planning. For equity funds, a long investment horizon of five years or more is generally recommended, as equities can be highly volatile in the short term. A longer horizon gives your investment more time to ride out short-term market fluctuations and potentially grow.

Large and mid-cap funds – Taxation of IDCW

Before March 31, 2020, IDCW income (earlier called mutual fund dividend plan) was tax-free in the hands of investors. At that time, the mutual fund companies (AMCs) paid a Dividend Distribution Tax (DDT) before releasing the payout.

However, Budget 2020 proposed a change to the rules and removal of DDT. Now, investors must pay tax on the full IDCW payout as per their income tax slab. This income is taxed under the head “Income from Other Sources.” Furthermore, TDS (Tax Deducted at Source) is now applicable if the total dividend received in a year is more than Rs 10,000.

Indexation benefit: Does it apply?

Indexation allows investors to adjust the purchase price of an asset to account for inflation, effectively reducing the net taxable gain. However, indexation benefit does not apply to equity-oriented mutual funds including large and mid-cap funds.

Previously, indexation benefits would apply for debt-oriented funds held for more than three years, but the benefit has now been removed.

Hence, long-term capital gains from large and mid-cap funds are taxed at the rate of 12.5% above the Rs 1.25 lakh exemption limit in a financial year, without the benefit of indexation.

How to calculate tax on mutual fund gains

- Determine the holding period to identify whether the gain is STCG or LTCG.

- Calculate the sale price minus the purchase price to compute capital gain.

- Apply the applicable tax rate:

- 20% on STCG

- 12.5% on LTCG exceeding Rs. 1.25 lakh exemption limit in a year

- Add IDCW income, if any, to your total income and compute tax as per slab rate.

Read Also: How to Save Tax with ELSS Mutual Fund

Tax-saving strategies while investing in mutual funds

- Hold investments for more than one year to qualify for LTCG exemption.

- Try to keep your redemption amount such that your gains are below Rs. 1.25 lakh in a financial year, so that you don’t need to pay capital gains tax.

- A Systematic Withdrawal Plan (SWP) allows you to redeem your investments gradually, potentially spreading out capital gains over time and improving overall tax efficiency.

- Equity Linked Savings Schemes (ELSS), a type of mutual fund, qualifies for tax benefits under Section 80C of the Income Tax Act, 1961. Investments in ELSS funds are eligible for a deduction of up to Rs. 1.5 lakh per financial year.

Comparing tax implications: Large vs mid cap funds

From a taxation perspective, both large cap funds and mid cap funds fall under equity-oriented mutual funds and hence have the same tax treatment. The final tax outgo of each fund will depend on the holding period and the potential capital gains earned.

So, when comparing tax implications, it is more important to focus on holding period, fund category (equity vs debt) and income slab.

Documentation and reporting for mutual fund taxation

- Maintain account statements from AMC

- Keep a record of purchase and sale NAVs, dates and number of units.

- At the time of ITR filing, disclose capital gains under relevant section of the form.

- Report IDCW income under “Income from Other Sources.”

Conclusion

Understanding the tax implications of large and mid-cap funds is an important part of managing your investment strategy effectively. These funds offer balanced exposure to well-established and relatively stable large cap companies as well as mid-cap companies that are in their growing stage, resulting in higher volatility as well as higher growth potential in the long term. Understanding the tax implications of potential gains from large and mid-cap funds can help you optimise your investment journey, allowing you to time holding periods and redemptions in a tax-efficient manner.

FAQs:

What is the capital gains tax on large and mid-cap mutual funds in India?

Capital gains tax is 20% on short-term capital gains (held for up to 12 months), and 12.5% on long-term capital gains (held for more than 12 months) exceeding Rs. 1.25 lakh in a financial year.

How are dividends from mutual funds taxed?

Income released by mutual funds are no longer called dividends. The name was changed by SEBI from dividend plan to IDCW. These payouts, if released, are now taxed in the hands of the investor as per their income tax slab. Also, a 10% TDS is deducted by the AMC for dividend amounts greater than Rs.10,000 in a financial year.

Is indexation benefit available for large and mid-cap funds?

No, indexation benefit is not available for any mutual fund category at present.

What is the minimum holding period to reduce tax on mutual funds?

A holding period of more than 12 months is required to qualify for long-term capital gains tax, which is lower than short-term capital gains tax for equity-oriented funds.

How can I file taxes on mutual fund investments?

You can report capital gains in your Income Tax Return (ITR) under the Capital Gains section and IDCW income under “Income from Other Sources.”

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.