Disclaimer The calculator alone is not sufficient and shouldn't be used for the development or implementation of an investment strategy. This tool is created to explain basic financial / investment related concepts to investors. The tool is created for helping the investor take an informed investment decision and is not an investment process in itself. Bajaj Finserv AMC has tied up with AdvisorKhoj for integrating the calculator to the website. Mutual Fund does not provide guaranteed returns. Also, there is no assurance about the accuracy of the calculator. Past performance may or may not be sustained in future, and the same may not provide a basis for comparison with other investments. Investors are advised to seek professional advice from financial, tax and legal advisor before investing in mutual funds.

Other Calculators

View AllEXPLORE OUR FUNDS

All Mutual Funds

MORE ABOUT INDEX FUND CALCULATOR

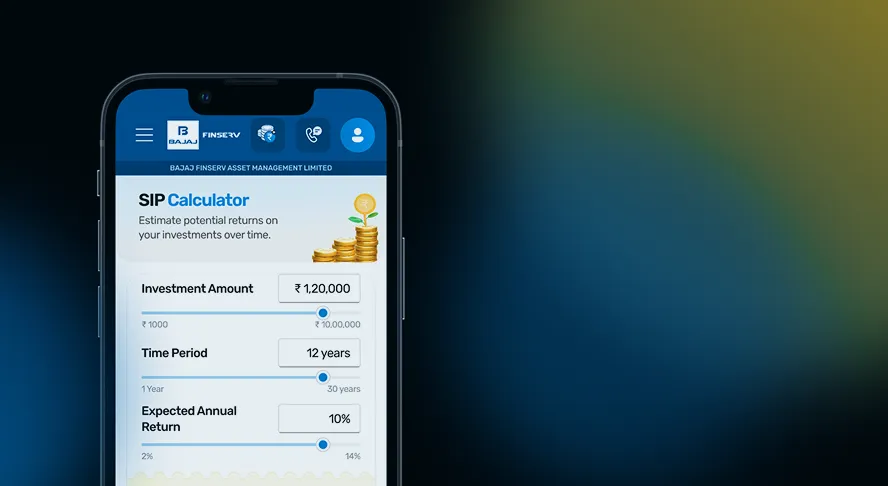

An index fund calculator is a useful tool that helps investors estimate the potential returns from their index fund investments over time. Whether you are investing through a lumpsum or a systematic investment plan (SIP), this calculator provides an approximate projection of how your money may grow, based on the chosen index, tenure, and expected rate of return. Tools such as an index fund SIP calculator or index fund return calculator may help you plan contributions better by comparing different investment scenarios. An SIP index fund calculator may be particularly useful for investors aiming to build wealth gradually over time. Similarly, an index fund investment calculator helps in understanding the potential outcomes of different strategies. Today, many platforms provide an index fund calculator online, making it accessible and simple to use. While results are indicative, they may guide in aligning investments with long-term financial goals.

An index fund calculator is a financial tool designed to estimate the potential value of investments in index funds over a chosen period. For those wondering what is index fund calculator, it is essentially a digital tool where you enter details such as investment amount, frequency (SIP or lumpsum), tenure, and an assumed rate of return. Based on this input, it provides an approximate projection of how your investment may grow. The index fund calculator meaning lies in simplifying complex return calculations, allowing investors to understand potential outcomes without manually working out numbers. In simple terms, the index fund calculator definition can be described as a planner that shows the potential wealth creation path of index fund investments, helping investors align with their long-term financial objectives. While the results are not guaranteed, they may serve as a guide for informed decision-making. The calculator is an aid, not a prediction tool. It may provide only an indicative picture.

An index fund SIP calculator works by estimating the potential returns from systematic investment plan (SIP) contributions into index funds. Investors enter details such as the SIP amount, investment period, and an assumed rate of return. The calculator then projects the total invested amount and the potential value at the end of the chosen tenure. This helps investors understand how consistent investments over time may accumulate and grow. The tool is useful for comparing different SIP amounts or timeframes, making it easier to plan long-term index fund investments. While the output is only an estimate, it provides clarity on how disciplined investing may contribute towards potential wealth creation.

An Index Fund SIP Calculator is a simple online tool that may help investors estimate the potential returns on their investments made through Systematic Investment Plans or SIPs in index funds. By entering basic details such as the monthly investment amount, investment duration, and expected rate of return, the calculator projects the potential value of the investment.

Its main use is to give investors a picture of how small, regular contributions may grow over time. It also helps in setting more informed financial goals, comparing different investment scenarios, and planning long-term wealth creation.

When considering how to calculate index fund returns, investors often rely on a standard investment calculation formula to estimate the potential value of their investments. The index fund investment calculation generally factors in the investment amount, expected rate of return, and the duration of investment. For SIP contributions, the calculation uses the future value of annuity formula, which helps project the estimated wealth created through regular contributions. This approach simplifies index fund investment calculation and provides an approximate idea of potential outcomes. While actual returns may vary due to market fluctuations, the formula gives a structured way to assess possible long-term results.

Index Fund Investment Calculation Formula (SIP)

Future Value (FV) = P × ((1 + r)n - 1) / r) × (1 + r)

Where:

P = SIP amount

r = expected annual rate of return (in decimal)

n = number of SIP installments

This formula helps estimate how disciplined investments may contribute to potential wealth creation over time.

-

Start by entering the SIP amount you plan to invest every month. This is the fixed contribution you wish to make in an index fund.

-

Add the investment tenure in years. Longer durations may show higher potential wealth creation due to compounding.

-

Enter the expected annual rate of return. Since markets fluctuate, use a realistic percentage while calculating.

-

The calculator will display both the total invested amount and the potential value of your investment at the end of the chosen period.

-

You may adjust SIP amount, tenure, or estimated return rate to compare different scenarios and plan effectively.

-

These tools may not guarantee results but offer useful guidance for investment planning.

Following such steps to use index fund calculator may help investors align contributions with long-term goals, and learning how to use online index fund calculator may further simplify the process by offering instant and accessible projections.

Using an index fund calculator may provide several advantages to investors by simplifying planning and offering clarity on potential outcomes. While it does not predict guaranteed results, it helps in creating an informed investment strategy. Below are some pros of index fund calculator tools.

Helps estimate potential returns:

- Provides an approximate projection of wealth creation through SIP or lumpsum investments.

- Shows the difference between invested amount and potential value at maturity.

Simplifies financial planning:

- Helps compare different SIP amounts, tenures, and return rates.

- Allows investors to adjust contributions to match long-term financial objectives.

Easily accessible online:

- Most platforms offer benefits of online index fund calculator tools free of cost.

- Quick results without manual calculations, saving time and effort.

Supports disciplined investing:

- Encourages consistent contributions by showing long-term potential.

- Reinforces the advantage of compounding through detailed projections.

These advantages of index fund SIP calculator tools make them useful for investors who want to plan systematically and evaluate potential scenarios before committing funds.

FAQS

The minimum investment in an index fund depends on the asset management company and mode of investment. It can be Rs. 500 per month. However, these limits vary across fund houses.

Most index fund calculators generally estimate potential returns based on assumed growth rates and investment tenure. They usually do not adjust for taxation. Investors may need to calculate tax implications separately.

Online index fund calculators provide indicative estimates based on inputs such as investment amount, tenure, and expected return rate. Actual returns may differ due to market fluctuations, expense ratios, and taxation. Therefore, these calculators may be suitable for planning, but they cannot assure accuracy of outcomes.

Index funds are passively managed mutual funds. They replicate a particular market index such as Nifty 50 or Sensex, aiming to match its performance. Fund managers only ensure alignment with the index composition rather than selecting securities actively. This approach generally keeps expense ratios relatively lower.

Index funds may be suitable for investors with a long-term horizon, typically five years or more. Since they track broader market indices, short-term fluctuations may impact performance. Staying invested over the long term provides potential for wealth creation and allows investors to benefit from compounding opportunities.

Most index fund return calculators estimate potential returns without adjusting for tax implications. Tax-adjusted returns usually require separate calculation by investors.

To use an index fund SIP calculator, you need to enter details such as SIP amount, investment tenure, and expected annual return rate. Some calculators may also allow you to adjust the frequency of SIP contributions. These inputs help estimate the potential returns from your investments.

An SIP calculator is designed specifically for Systematic Investment Plan calculations. For lumpsum investments, most fund houses or financial websites provide a separate lumpsum calculator or option to toggle the investment type to 'lumpsum'.