Understanding Fund Concentration and Its Impact on Returns

Investing in mutual funds is a popular way for people to grow their money without needing expert knowledge of the stock market. But have you ever heard about fund concentration? It's an important concept to understand because it can affect how your investments perform. Let's break it down in simple terms.

- Table of contents

- What is fund concentration?

- Impact of fund concentration on mutual fund returns

- Understanding concentrated large-cap funds

What is Fund Concentration?

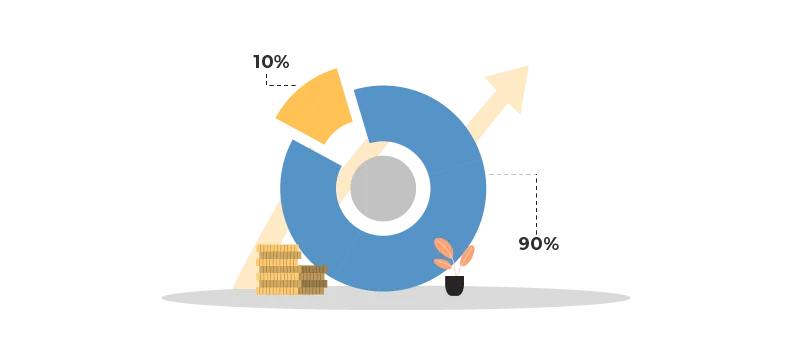

Fund concentration refers to a strategy in which a mutual fund invests in a small number of stocks or bonds rather than spreading out investments across many different ones. Fund managers make decisions about which stocks or bonds to invest in based on their research and conviction about which ones will perform well. Sometimes, they might feel very confident about a particular company or industry, so they invest a lot of the fund's money in it.

For example, imagine a mutual fund that invests mostly in technology companies. If the technology sector does well, the fund might see big gains. But if the sector experiences problems, the fund could suffer heavy losses because it's heavily concentrated in that area.

Impact of Fund Concentration on Mutual Fund Returns

Now, let's talk about how fund concentration can affect the returns you get from your investment.

- Potential for higher returns: When a fund is heavily concentrated in a few stocks or sectors, it has the potential to generate higher returns if those investments perform well. This is because the gains from those investments can have a bigger impact on the overall performance of the fund.

- Increased risk: On the other side, fund concentration also brings increased risk. If the stocks or sectors that the fund is heavily invested in don't perform as expected, the fund's returns could suffer significantly. This is because the fund's performance is more closely linked to the performance of those few investments.

Understanding Concentrated Large Cap Funds

Concentrated large cap funds are focused portfolio of large-cap stocks, focusing on a select few companies that may potentially outperform the market in long term. This strategy requires deep research and conviction from the fund managers, as they seek to capitalize on their unique insights into individual companies.

A concentrated fund typically aligns with a high active share strategy, as both emphasize focused investments with limited diversification, aiming to outperform their benchmarks through selective portfolio choices. Thus, while high active share indicates a deviation from the benchmark index, it also signifies a higher level of fund concentration. This concentration means that the fund's performance is closely tied to the success or failure of a limited number of investments, magnifying both potential gains and risks for investors.

Conclusion

Fund concentration is an essential concept for investors to understand because it can have a significant impact on investment returns. While concentrated funds have the potential for higher returns, they also come with increased risk due to lack of diversification.

FAQs

What are the key indicators of fund concentration?

Key indicators of fund concentration include the number of holdings in the fund, the percentage of assets invested in the top holdings, and the level of overlap with the benchmark index.

Can fund concentration lead to higher returns?

Fund concentration can potentially lead to higher returns if the concentrated investments perform well.

How does fund concentration affect risk exposure?

Fund concentration affects risk exposure by magnifying both potential gains and losses. With fewer investments making up a larger portion of the fund's holdings, the fund becomes more sensitive to the performance of those specific investments, increasing overall risk.

What are the risks of investing in a concentrated fund?

Concentrated funds invest in a limited number of stocks or sectors. This can lead to higher risk. If the chosen stocks or sectors underperform, the entire fund can be significantly impacted. Lack of diversification increases the risk of substantial losses.

How does fund concentration differ from diversification?

Diversified funds spread investments across a wider range of stocks and sectors, reducing risk. Concentrated funds, by focusing on a few holdings, aim for potentially higher returns but with significantly increased risk.

What factors should investors consider before investing in concentrated funds?

Investors should carefully assess their risk tolerance, as concentrated funds carry higher risk. Thoroughly research the fund manager's expertise and the chosen stocks or sectors. Additionally, maintain a diversified portfolio with other funds that offer broader diversification and debt funds that offer relative stability.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.