Budget 2024: All you need to know about proposed changes to mutual fund capital gains tax

The Union budget for the financial year 2024-25 proposed new taxation rules for capital gains on mutual funds. Here is an overview of the proposed changes, what they mean for investors, and how a long-term view towards investing can help you reduce your tax burden and optimise return potential.

- Table of contents

- Capital gains: Old rates vs new rates

- Short-term and long-term capital gains tax for equity-oriented mutual fund

- Tips to reduce tax outflow

- How Budget 2024 Impacts Mutual Fund

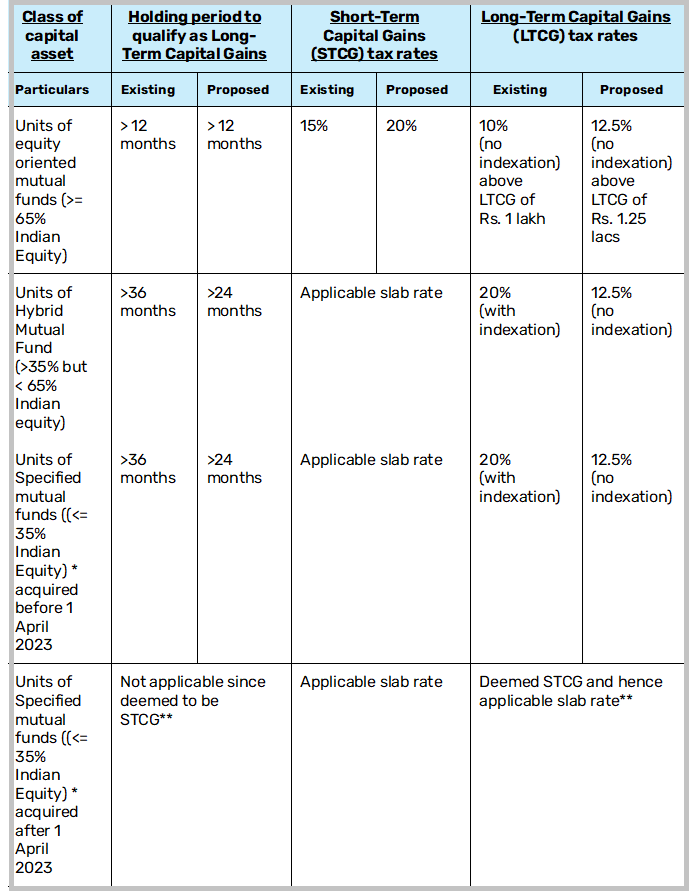

Capital gains: Old rates vs new rates

The table below gives you a comprehensive overview of the proposed tax rates for mutual funds. These will be applicable to capital gains arising after July 23, 2024 (subject to the Finance Bill being passed in Parliament and receiving Presidential assent).

*This proposed amendment will cover mutual funds that invest more than 65% in debt and money market instruments instead of existing definition, which captures mutual funds that invest less than or equal to 35% in Indian equity – interestingly, this definition change is applicable with effect from 1 April 2025

**There are views to explore LTCG rates but such views are likely to be litigative

Short-term and long-term capital gains tax for equity-oriented mutual fund

In order to save taxes and lessen your tax burden, it's important to understand the nuances of short-term and long-term capital gains tax on mutual fund. Here's a brief overview of the same:

Short-term capital gains tax

Short-term capital gains tax (STCG) is levied on capital gains arising when units of mutual funds are held for less than the specified period, i.e. 12 months. A capital gain is the profit earned when redeeming mutual fund units. It is the difference between the purchase price and sale price of these units.

Let’s look at the resultant change in the tax rate using an example. Let’s assume you have invested in lumpsum in an equity oriented mutual fund. You withdrew all your investment (capital plus gains) in 11 months. Here is how your tax outflow will change.

| Invested Amount | Value at Redemption | Capital Gains | Earlier STCG Taxed at the Rate of 15%* | New STCG Taxed at the Rate of 20% |

|---|---|---|---|---|

| Rs. 1,00,000 | Rs. 1,10,000 | Rs. 10,000 | Rs. 1,500 | Rs. 2,000 |

| Rs. 1,50,000 | Rs. 1,65,000 | Rs. 15,000 | Rs. 2,250 | Rs. 3,000 |

Note: The assumed return rate for this example is for illustrative purposes only. The STCG calculation given here excludes applicable surcharge and Education cess. These rates are not applicable to ETFs.

Read Also: ELSS mutual funds: Features, benefits, and investment tips

Long-term capital gains tax

Long-term capital gains tax (LTCG) is levied on capital gains arising when a mutual funds are held for a specified period i.e. more than 12 months.

The example below shows the impact of this change on investors. Let’s assume you have invested in lumpsum in an equity oriented mutual fund scheme, where you earn 12% returns. In scenario one, you redeem all units at the end of 10 years. In scenario two, you redeem all units at the end of 19 years.

Here’s what tax outflow would be as per the old rates:

Note: This example assumes a fixed rate of return and is for illustrative purposes only. Returns may fluctuate and are not guaranteed. The LTCG calculation given here excludes applicable surcharge and education cess. These rates are not applicable to ETFs.

As you can see in the examples above, the LTCG tax may increase or decrease under the new rules, depending on the redemption amount.

| Invested Amount | Holding Period | Value at Redemption | Capital Gains | Post Exemption Gains – Old Regime | Old LTCG Tax* | Post Exemption Gains – New Regime | New LTCG Tax* |

|---|---|---|---|---|---|---|---|

| 1,00,000 | 10 years | Rs. 3,10,585 | Rs. 2,10,585 | Rs. 1,10,585 | Rs. 11,059 | Rs. 85,585 | Rs. 10,698 |

| 1,00,000 | 19 years | Rs. 8,61,276 | Rs. 7,61,276 | Rs. 6,61,276 | Rs. 66,128 | Rs. 6,36,276 | Rs. 79,534 |

Tips to reduce tax outflow

Despite these changes, investors can follow some tips to reduce their tax burden:

Have a long-term view:

In the old and new rules, the LTCG tax rate is lower than the STCG tax rate. This is done to encourage a long-term view to investing. Equity mutual funds are suitable for longer investment horizons. This is because markets can be very unpredictable and can show high volatility in the short term. Over longer horizons and market cycles, however, they have historically stabilized and shown positive growth (past performance may or may not be sustained in the future). A long investment horizon can therefore mitigate the impact of short-term fluctuations on the investment.

Redeem only as much as you need:

Investors need to pay tax only when they redeem units. Moreover, tax is levied only on the redeemed amount. So, to reduce your tax burden, it is advisable that you redeem only as much as you need. If your finances allow it, you can spread your redemptions over multiple financial years, to further minimize your tax burden. Moreover, capital gains of up to Rs 1.25 lakh are exempt from LTCG tax. Even if the capital gains from redeemed units are higher, you can reduce the tax amount by keeping your gains as close to Rs 1.25 lakh as possible.

Invest in tax-saving options:

As an overall strategy to reduce your annual taxes, you can invest a portion of your money in Equity Linked Savings Scheme (ELSS) mutual funds. This is applicable if you have opted for the old regime of the Income Tax Act, 1961. Under Section 80C of the old regime, investments of up to Rs 1.5 lakh in select schemes are tax-exempt. This includes ELSS funds, public provident funds, National Savings Certificates and more. Considering the SIP route for mutual fund investments? A MF SIP calculator helps you to plan your investments by estimating the potential returns.

Read Also: Tips for tax-efficient mutual fund investing

How Budget 2024 Impacts Mutual Fund

The changes made in the union budget impacts mutual fund investors differently depending on their fund type and investment horizon. Overall, these revisions may lead investors to favor longer holding periods to reduce tax liability.

Below is a summary of the key implications:

Equity mutual funds: The increase in short-term capital gains (STCG) tax on equity mutual funds from 15% to 20% may make short-term trading in these funds less attractive.

With the marginal increase in LTCG tax on equity funds from 10% to 12.5%, but with a raised exemption limit of ₹1.25 lakh, more investors might prefer long-term investments.

Simplification: The clarification regarding the tax treatment of different categories of mutual funds, such as hybrid funds, could lead to more informed investment decisions by removing ambiguity.

FAQs:

What are the proposed changes to mutual fund capital gains tax in Budget 2024?

Short-term capital gains tax for equity funds (holding at least 65% Indian equity) has increased from 15% to 20%, while long-term capital gains tax has risen from 10% to 12.5%. The annual tax exemption limit for LTCG has also been raised, from Rs 1 lakh to Rs 1.25 lakh. For hybrid funds (holding more than 35% but less than 65% of equity), the holding period to qualify for long-term capital gains has been reduced from 36 months to 24 months. Short-term capital gains tax will continue to be taxed as per the tax slabs while LTCG will be taxed at 12.5% (with no exemption and indexation benefits). Before Budget 2024, these funds had a 36-month holding period to qualify for LTCG and the LTCG rate was 20% with indexation benefits.

For debt fund units purchased after April 1, 2023, the tax structure remains unchanged – capital gains will be taxed as per the investor’s income tax slab rate, regardless of the holding period.

How will the new tax rates impact short-term and long-term mutual fund gains?

For equity mutual funds, the STCG tax on equity mutual funds has increased from 15% to 20%, which may further discourage short-term investing. The LTCG tax has risen from 10% to 12.5%, but the exemption limit has been raised from Rs 1 lakh to Rs 1.25 lakh. The tax burden can decrease or increase, depending upon the redemption amount.

What strategies can investors use to minimize mutual fund taxes?

Hold investments long-term to qualify for lower capital gains tax for equity and hybrid funds. Use tax-loss harvesting to offset gains with losses. Keep withdrawals within the Rs 1.25 lakh exemption limit for equity-oriented funds.

Are there any tax-saving investment options available under the new rules?

ELSS is the only mutual fund scheme offering tax benefits. These funds invest in equities and have a 3-year lock-in, offer potential long-term growth. Investments in ELSS qualify for a Rs 1.5 lakh deduction under Section 80C of the Income Tax Act, 1961, reducing taxable income. The 2024 Budget has not made any changes to this.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.