Nimesh Chandan has over 24 years of experience in the Indian Capital Markets. He has spent 18 years in Fund Management- managing and advising domestic and international investors, retail as well as institutional. Prior to joining Bajaj Finserv Asset Management Ltd., he has worked with Canara Robeco Asset Management as Head of Investments, Equities (Domestic and Offshore). He has also worked with other asset management companies including Birla Sunlife Asset Management, SBI Asset Management and ICICI Prudential Asset Management.

Category of Scheme

Low Duration Fund

Benchmark

NIFTY Low Duration Debt Index A-I

Min. SIP Amount

₹1000

Inception Date

20-02-2026

Benefits of Investing in Bajaj Finserv Low Duration Fund

Short-term avenue

The fund can be a suitable place to park funds for short-term goals

Maturity profile

Short maturity profile makes the fund less sensitive to interest rate changes compared to other debt funds.

Liquidity and flexibility

Short maturity profile enables efficient liquidity management for investors.

Investment Objective

The investment objective of the Scheme is to generate optimal returns for its investors through a portfolio constituted of debt and money market securities. The Macaulay duration of the portfolio is managed between 6 months and 12 months, resulting in a low duration investment with relatively high interest rate risk and moderate credit risk. The Scheme seeks to offer a short-term savings avenue with low risk while balancing yield and liquidity.

However, there is no assurance that the investment objective of the Scheme will be achieved.

Asset Allocation

| Instruments | Indicative allocations (% of total assets) | |

|---|---|---|

| Minimum | Maximum | |

| Debt and Money Market Instruments* (including Triparty Repos on Government Securities or treasury bill & Repo, units of mutual funds) such that the Macaulay duration of the portfolio is between 6 months and 12 months. | 0% | 100% |

*Money market instruments will include commercial papers, commercial bills, Triparty REPO, Reverse Repo and equivalent and any other like instruments as specified by SEBI and Reserve Bank of India from time to time.

Who Should Invest in Bajaj Finserv Low Duration Fund?

The fund may be suitable for:

- Investors who want an investment avenue for near-term goals or parking of surplus funds.

- Investors looking for the potential for regular income from their investments.

- Corporates managing short-term cash flows.

- Investors looking to park surplus funds and gradually transfer them into equity or hybrid funds through a systematic transfer plan (STP).

Fund Managers

Fund Details

Type of Scheme

Bajaj Finserv Low Duration Fund

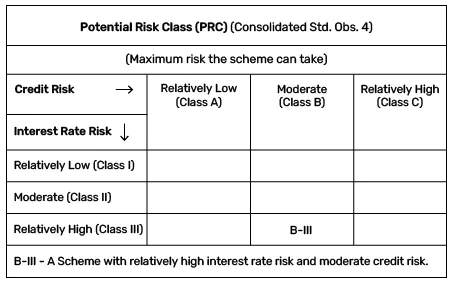

An open ended low duration debt scheme investing in instruments such that the Macaulay Duration of the portfolio is between 6 months to 12 months (please refer to page no. 34 of the SID)# with relatively high interest rate risk and moderate credit risk.

# Please refer to the page number of the Scheme Information Document on which the concept of Macaulay Duration has been explained.

Minimum Additional Purchase Amount

On Ongoing basis

Rs. 1000/- and in multiples of Re. 1/- thereafter.

Minimum Redemption/switch out amount

Re. 1 and in multiples of Re. 0.01/- or the account balance of the investor, whichever is less.

Minimum Application Amount

During NFO:

Minimum application amount (lumpsum): Rs. 5000/- and in multiples of Re. 1/- thereafter. Systematic Investment Plan (SIP): Rs. 1000 and above: minimum 6 instalments.

During ongoing offer

- Fresh Purchase (lumpsum): Rs. 5000/- and in multiples of Re. 1/- thereafter Systematic Investment Plan (SIP): Rs. 5000 and above: minimum 6 instalments. Minimum amount for switch-in: Rs. 5000 and in multiples of Re. 1.

- Two-Factor Authentication will be applicable for subscription as well as redemption transactions in the units of Mutual Fund.

- For more information, please refer SAI.

Load Structure/Lock-In Period

Entry Load:Nil

Exit Load:Nil

Plan

- Bajaj Finserv Low Duration Fund – Direct Plan

- Bajaj Finserv Low Duration Fund – Regular Plan

Potential Risk Class (PRC)

- The PRC matrix identifies the highest amount of potential risk that a debt mutual fund can assume.

- This regulation was implemented by SEBI on December 1, 2021, making it essential for fund houses to categorize all new and existing schemes under a potential risk class (PRC) matrix.

Product Label and Riskometer

This product is suitable for investors who are seeking*:

- income over short term

- to generate income/capital appreciation through investments in low duration debt and money market instruments

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Bajaj Finserv Low Duration Fund: Overview

The Bajaj Finserv Low Duration Fund is an open-ended debt scheme investing in debt and money market instruments such that the Macaulay duration of the portfolio is between 6 and 12 months. Investors who typically allocate to liquid or money market funds may consider investing incrementally in this fund to potentially benefit from market volatility or rate cut cycles, without significantly changing the duration of their portfolios.

The fund may also be suitable for investors seeking the potential to benefit from any downward movement in rates without taking exposure to long-duration instruments. The fund may also serve as an avenue to park surplus funds or for short-term goals.

How does Bajaj Finserv Low Duration Fund work?

The Bajaj Finserv Low Duration Fund will invest across money market instruments, corporate bonds, and non-convertible debentures. It will allow selective exposure to securities beyond one-year maturity (while maintaining the required Macaulay duration of 6 to 12 months) to enhance return potential. Fund managers may actively manage the portfolio by adjusting maturity, credit exposure, and instrument selection based on interest rate conditions and liquidity considerations. Low duration fund returns are influenced by factors such as interest rate movements, credit quality of holdings, and prevailing market conditions, and may vary over time.

Bajaj Finserv Low Duration Fund - Regular & Direct Plans

Those investing in the Bajaj Finserv Low Duration Fund can choose between two plans:

Regular plan

A regular plan involves investing through a mutual fund distributor who supports investors with scheme selection, application processes, and transactions. The expense ratio for this plan is typically higher, as it includes distributor commissions paid by the asset management company. However, investors receive guidance that may help them align their investments with their financial goals and risk profile.

Direct plan

A direct plan is designed for investors who are comfortable making and managing their own investment decisions. These plans generally have a lower expense ratio, which may contribute to higher net returns over the long term. However, investors need to research market conditions, make scheme selections, and monitor their investments independently.

How to invest in Bajaj Finserv Low Duration Fund?

You can invest in the Bajaj Finserv Low Duration Fund in the following ways:

Online: You can visit Bajaj Finserv AMC’s official website and navigate to the transaction portal from the ‘Invest Now’ button on this page or the Login/Register tab on the home page. There, you can invest through a seamless and secure digital process. You can also invest through an aggregator platform, on MF Utility, or through a Registrar and Transfer Agent.

Offline: You can fill out the application form and submit it at the nearest official point of acceptance (OPAT) of Bajaj Finserv AMC. If you’re investing through a distributor, they will typically help you with filling out and submitting the application form.

Taxation on Bajaj Finserv Low Duration Fund

Capital gains and income from the Bajaj Finserv Low Duration Fund will be taxable as follows:

- Capital gains: From April 1, 2023, all capital gains on debt mutual funds are deemed to be short-term capital gains, regardless of the holding period. They are taxed as per the investor’s slab rates (plus applicable surcharge and cess).

- Income Distribution cum Capital Withdrawal (IDCW): IDCW payouts are also taxed as per the investor’s income tax slab.

Explore Related Debt Funds

| Overnight Fund | Money Market Fund | Liquid Fund |

|---|---|---|

| Gilt Mutual Fund | Banking & PSU Fund |

Explore All Schemes

| Equity Funds | Debt Funds | Hybrid Funds | Index Funds |

|---|---|---|---|

| Exchange Traded Fund Funds | Savings Plus | All Mutual Funds |

Frequently Asked Questions

The suitability of this fund depends on the investor’s financial goals, risk appetite, investment horizon, liquidity needs, and overall portfolio allocation. The fund may be suitable for investors seeking a relatively stable investment avenue for short-term goals.

A low duration fund is a debt mutual fund that invests in debt and money market instruments while maintaining a portfolio Macaulay duration of 6-12 months. Such a fund seeks to manage interest rate risk while generating accrual-based returns over a short time horizon.

The portfolio Macaulay duration of a low duration mutual fund is 6 to 12 months. It may be suitable for short-term goals.

The scheme's inception date is February 20, 2026.

While they seek to maintain relative stability and manage interest rate risk, low duration debt funds are not risk-free – as with all market-linked instruments, returns are not guaranteed and low duration fund performance depends on market conditions.

The minimum investment amount may vary from one fund house to another. For the Bajaj Finserv Low Duration Fund, the minimum SIP amount is Rs. 1,000 (with minimum six instalments). It is recommended to check the scheme documents for up-to-date information and terms and conditions.

A low duration fund is a scheme that invests in debt and money market securities while maintaining a Macaulay duration of 6 to 12 months for its portfolio. It falls under the category of debt mutual funds.

The low duration fund taxation structure is the same as that of all debt funds. Capital gains from low duration funds are taxed as per an investor’s income tax slab. Income distributed to investors who opt for the IDCW option is also taxed as per applicable slab rates.

Learn About Mutual Funds

Posted On: 04 July 2023

When it comes to investing in the stock market, diversification is a key strategy to…

Posted On: 21 Aug 2025

Multi cap and mid cap funds each offer a distinct approach to equity exposure. In…

Posted On: 21 Aug 2025

Many investors with limited experience and modest funds may not have the bandwidth to invest…

Related Video

Mutual Funds For Beginners - Mutual Fund Kya Hai Aur Kaise Kaam Karta Hai

Posted On: 22 Sep 2025

What Is Top Up In Mutual Fund SIP

Posted On: 24 Sep 2025

Common Mistakes Investors Make While Watching The Market Closely

Posted On: 14 Oct 2023