Build a dynamic and diversified portfolio with flexi cap funds

A diversified investment portfolio is important for long-term wealth creation and mitigating risks from market volatility. Such a portfolio aims to balance risk and return through strategic allocation across more than one asset type or asset class.

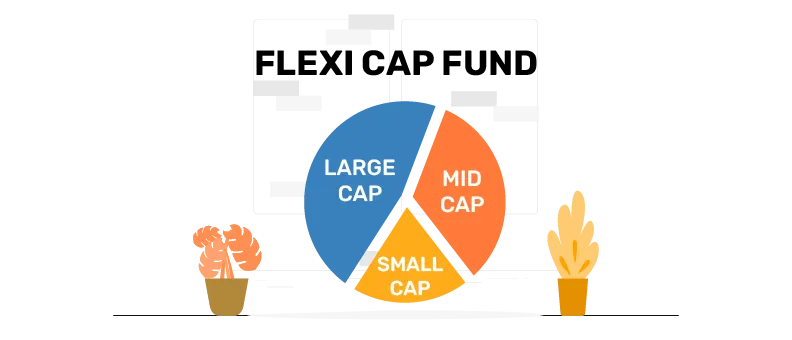

Building such a portfolio is one of the aims of a flexi cap mutual fund, which has emerged as a popular investment option in recent years. Flexi cap funds can allocate assets across large, mid, and small cap companies and alter the portfolio based on market trends. Thus, they can combine the relative stability of large cap companies with the growth potential of mid and small cap firms to potentially generate capital appreciation in the long run. Read on to find out how to achieve long term growth with flexi cap fund.

- Table of contents

- Flexi cap funds for flexibility

- Selecting flexi cap funds for a diversified portfolio

- How to incorporate flexi cap fund for long term growth?

- Taxation on flexi cap funds

Flexi cap funds for flexibility

Flexi cap funds are open-ended equity schemes that can alter their investments in companies of varying sizes – large, mid or small – in response to market movements. Unlike multi cap funds, which must invest at least 25% of their assets in large, mid, and small cap companies, respectively, flexi cap funds are not constrained by a fixed allocation. Their only requirement is to always ensure a 65% equity component in the portfolio.

This flexible mandate allows the fund manager to adapt to changing market conditions and potentially tap into opportunities offered by different market segments by increasing or decreasing their exposure in the portfolio.

Selecting flexi cap funds for a diversified portfolio

When choosing flexi cap funds, investors must analyse the fund manager’s track record and portfolio allocation strategy. Look at historic returns over long durations – such as 3 and 5 years – to assess the fund's ability to deliver returns across multiple market cycles. Consistency, rather than brief spikes in returns, should be assessed.

Do note, however, that past performance does not predict future returns.

Investing in a few large, well-managed flexi cap schemes can potentially provide adequate diversification while mitigating scheme-specific risks.

Read Also: Difference between index funds and flexi-cap funds

How to incorporate flexi cap fund for long term growth

Conservative investors who want to incorporate flexi cap funds into their portfolio but limit their exposure to risk can choose a core-satellite strategy where the base of the portfolio comprises relatively stable mutual funds and a few high-performing flexi cap funds are included as satellites. Here are some tips to leverage flexi cap fund for growth.

- Debt funds, large cap equity funds, index funds, or exchange-traded funds can form the core portfolio for steady medium to long term returns, while flexi cap schemes can act as satellites for higher growth potential.

- Choosing 2-3 high-performing flexi cap funds can potentially provide diversification across segments without over-concentration in a single category.

- Regular rebalancing can ensure that the asset mix is not distorted from the original asset allocation targets.

- Avoid chasing short-term performance and make redemptions only when needed rather than booking gains.

- In high-risk avenues, investment through SIPs can help mitigate risk owing to rupee cost averaging.

This approach can potentially help investors make the most of flexi cap funds' flexibility in identifying lucrative opportunities at different stages of the economic and market cycle over the long run.

Taxation on flexi cap funds

As per current Indian tax laws, any capital gains above Rs. 1 lakh from equity investments held for more than one year are considered long-term capital gains and are taxed at 10%. Short-term capital gains (STCG) on equity investments sold before one year are taxed at 15%. Dividend income from flexi cap funds is taxable as per the investor's tax slab.

Conclusion

Flexi cap funds can be suitable for investors seeking to capitalise on growth opportunities while mitigating scheme-specific risks. Their flexible mandate offers diverse opportunities across market segments. Pursuing a systematic investment approach and periodically reviewing the portfolio can help leverage flexi cap funds for building a well-diversified portfolio. You can also consider investing in the Bajaj Finserv Flexi Cap Fund, which aims to deliver long term capital appreciation through active fund management. It is recommended that you consult a financial advisor before making any investment decisions.

FAQs

What is the ideal allocation of flexi cap funds in a diversified portfolio?

That depends on the individual’s risk appetite and goals. A risk-tolerant investor may be comfortable with a larger portfolio allocation to flexi cap funds, while a risk-averse one may feel better with large cap funds. Your investment horizon, financial goals and current financial commitments should also be factored in.

How often should I review and rebalance my flexi cap fund portfolio?

It is generally recommended that you review your portfolio at least once a year. During the annual review, you should evaluate the funds’ performance relative to its category peers and its benchmark. The review also allows you to check if the funds are still aligned with your risk profile and financial goals. Most financial experts suggest rebalancing the portfolio if the allocation to a particular fund has drifted by 5 percentage points or more from the original asset allocation.

Is flexi cap fund good for long-term investment?

Flexi cap funds can be a suitable long-term investment option. By investing in equities, they offer the potential to build wealth over time. Moreover, their dynamic nature can help them potentially optimise returns by adapting to market conditions and leverage opportunities across market capitalisations. However, investors should consider their risk tolerance and financial objectives before selecting a fund Consulting with a financial advisor is advisable.

Which is better, multi cap or flexi cap?

The choice between multi cap and flexi cap depends on your risk appetite and the investment style that aligns with your investment goals and preferences, among other factors. Multi cap funds must invest at least 25% pf their portfolio to large, mid, and small cap stocks each. Flexi cap funds, on the other hand, have the flexibility to choose how to allocate assets across these three market capitalisations based on market conditions. There is no minimum market cap-wise allocation requirement. This means that the fund manager can flexibly alter the asset allocation pattern in response to market conditions and their insights. If you prefer a structured allocation with guaranteed and even allocation across market caps, multi cap funds may be preferrable. If you prefer adaptability and active management, flexi cap funds can be appealing. Consulting a financial advisor is recommended when making major investment decisions.

Is flexi cap fund better than index fund?

The fund that is suitable for you depends on your investment objective, risk appetite and preferences. Index funds may be suitable for those who prefer a passive investment style where the fund’s objective is to match the benchmark index (subject to a tracking error). A flexi cap fund may be suitable for investors seeking a diversified portfolio with a high degree of active management and exposure to all market capitalisations.

Can I do an SWP in flexi-cap funds?

Yes, you can typically set up a Systematic Withdrawal Plan (SWP) in flexi-cap funds. However, you will need to check if your Asset Management Company (AMC) offers this facility and what their policies regarding SWP withdrawals are. You can use an SWP calculator to plan withdrawals efficiently based on your financial needs.

How can a lumpsum calculator help me plan my investments?

A lumpsum calculator gives you an estimate of how much your one-time investment could potentially grow over a chosen period, based on expected returns. It helps you set realistic financial goals, compare options, and decide how long to stay invested—making your planning more informed and goal-oriented. However, it's essential to note that the calculator's estimates are for illustrative purposes.

What role does an SIP return calculator play in building a diversified portfolio with flexi cap funds?

An SIP return calculator allows investors to project potential returns from regular investments in flexi cap funds, facilitating effective diversification and strategic financial planning.

How can I increase my investments in flexi cap funds systematically?

A step up SIP lets you plan structured increases in your SIPs, helping you potentially take advantage of the dynamic nature of flexi cap funds while increasing your invested capital gradually. A step up SIP calculator can help you plan your approach.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.