How to use alpha to evaluate mutual funds?

Investing in mutual funds continues to be a popular method among new and seasoned investors to grow their wealth over time. However, with so many mutual funds available, it can be challenging to determine which ones are suitable and worth investing in. One useful tool for evaluating mutual funds is Jensen’s Alpha.

Let’s take a closer look at what Alpha is, how to use Jensen’s Alpha to evaluate mutual funds, and how it can fit into your investment strategy.

- Table of contents

- Understanding Alpha in mutual funds

- Calculation of Alpha in mutual funds

- Why alpha is important for mutual fund investors?

- Why the alpha is important for mutual fund managers

- The role of alpha in fund selection

- Using alpha to evaluate mutual funds

- Leveraging Alpha in investment strategy

- Alpha vs Beta in mutual funds

Understanding Alpha in mutual funds

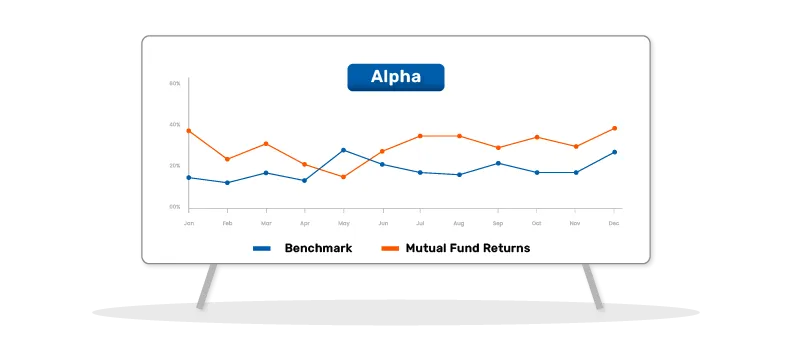

Alpha is a measure of a mutual fund's performance compared to a benchmark index. It shows how much better or worse a fund performed compared to what was expected, based on the market's overall performance. Simply put, Alpha tells you if the fund manager's investment decisions have added value beyond just following the market trends.

Calculation of Alpha in mutual funds

Alpha is calculated using the following formula:

Alpha = Fund Return − (Benchmark Return + β × (Market Return − Risk-Free Rate)

Returns from government bonds are typically considered as the risk-free rate, while the benchmark index return is considered as the market return. Beta measures the fund's volatility relative to the market.

For example, let’s say the Alpha of a mutual fund is +2. This means the fund has earned 2% more than its benchmark index. If the Alpha is -1, it means the fund has delivered returns that are 1% lower than the benchmark.

Positive Alpha: A positive Alpha indicates that the fund manager has outperformed the benchmark index, after adjusting for risk.

Negative Alpha: A negative Alpha suggests that the fund manager has underperformed the benchmark index.

Zero Alpha: A zero Alpha indicates that the fund manager has performed in line with the benchmark index.

Read Also: What is alpha and beta in mutual funds?

Why alpha is important for mutual fund investors?

Alpha is essential for mutual fund investors for several reasons:

1. Measures performance

Positive alpha indicates outperformance of the benchmark, suggesting skill in stock selection and timing.

Negative alpha indicates underperformance and can possibly indicate poor management or ineffective strategies. However, it can also mean that the fund manager’s approach has a long-term pay off but may not lead to benchmark-beating returns in the short-term. Moreover, even a skilled fund manager may not beat the benchmark every year. Hence, it is important to assess returns over multiple horizons to get a more holistic picture.

2. Helps select better performing funds

By focusing on funds with positive alpha, investors can select funds that have historically outperformed the benchmark. However, it is essential to note that past performance may or may not be sustained in the future.

3. Indicates fund manager’s skill

Alpha helps distinguish fund managers whose decision-making process has helped them perform better than the relevant market segment and has added value to the fund’s performance.

4. Encourages active management

Alpha incentivizes managers to make strategic stock selections, aiming for returns that can exceed the benchmark in the long term.

Other factors like risk, expense ratios, and objectives should also be considered when selecting funds.

Why the alpha is important for mutual fund managers

Alpha is a critical measure of a fund manager's skill and a crucial factor in the competitive landscape of the mutual fund industry. Here are some reasons why:

Performance benchmark: Alpha indicates a fund manager's ability to outperform the benchmark index. A positive alpha signifies that the manager has generated excess returns beyond what could be achieved by simply following the market. This is an important metric for indicating skill and justifying higher management fees for actively managed funds. However, alpha measures past performance, and there is no guarantee that it will be sustained in the future.

Investor attraction: A strong track record of positive alpha can attract investors by showcasing the fund manager's expertise and potential to deliver better returns in the long term.

Competitive advantage: In a competitive industry, achieving a sustained alpha advantage can be an important differentiator.

Incentive for active management: Alpha incentivises fund managers to actively research, select stocks, and manage their portfolios with the goal of outperforming the market. This benefits investors by encouraging active and skillful management.

The role of alpha in fund selection

Alpha is an important factor in selecting mutual funds because it indicates the fund manager’s ability to potentially outperform the market. This market-beating potential is the main reason for investors to invest in active mutual funds. The idea is that investors may be compensated for higher expense ratios by superior return potential in the long term. Alpha also offers a standardised way to compare funds in the same category and make informed decisions.

However, it is essential to note that past performance may or may not be sustained in the future, a positive or negative alpha over a brief cycle may not indicate the fund’s long-term resilience, and other factors like risk, expense ratios, and the manager's investment process should also be considered.

Using alpha to evaluate mutual funds

To understand how to use Jensen’s Alpha to evaluate mutual funds, let’s go through an example.

Let’s assume you are evaluating a mutual fund called XYZ Fund. Over the past year, XYZ Fund had a return of 12%. The benchmark index had a return of 10%, and the market return was 8%. The risk-free rate, which is the return on a very safe investment like government bonds, was 2%. The Beta of XYZ Fund is 1.1.

Using the Alpha formula:

Alpha = 12% − (10% + 1.1 × (8% − 2%)) Alpha = 12% − (10% + 1.1 × 6%) Alpha = 12% − (10% + 6.6%) Alpha = 12% − 16.6% Alpha = -4.6%

In this example, the XYZ Fund has an Alpha of -4.6%, meaning it underperformed its benchmark by 4.6%. This indicates that the fund manager’s decisions did not add value compared to the benchmark index.

Leveraging Alpha in investment strategy

Alpha can be a valuable tool in your investment strategy. By analysing Alpha, you can identify which mutual funds are likely to provide better returns relative to their benchmarks. Here are some tips to use Alpha effectively:

- Compare Alphas: Look at the Alpha of different mutual funds to see which ones have consistently higher Alphas. This can help you identify skilled fund managers.

- Historical performance: Evaluate the historical Alpha of a fund. A fund with a consistently positive Alpha may potentially be a better choice.

- Risk assessment: Consider the Beta along with Alpha. A high Alpha with a reasonable Beta suggests good performance without excessive risk.

- Diverse portfolio: Use Alpha to diversify your investments. Don’t rely on Alpha alone but use it with other metrics to build a balanced portfolio.

Alpha vs Beta in mutual funds

Alpha and beta are essential metrics for evaluating mutual fund performance and risk.

Alpha

Definition: Alpha measures a fund's excess return relative to its expected return, after accounting for risk (beta).

Interpretation: Positive alpha indicates that the fund manager has outperformed the benchmark for a given level of risk.

Negative alpha suggests underperformance compared to the benchmark.

Beta

Definition: Beta measures a fund's volatility compared to its benchmark index.

Interpretation: A beta of 1 means the fund moves in line with the market. A beta greater than 1 indicates higher volatility, and less than 1 indicates lower volatility.

Key takeaway: Beta gauges the fund's risk and market sensitivity.

In summary, Alpha measures the fund manager's ability to generate excess returns. Beta measures the fund's volatility and risk compared to the market.

Understanding both alpha and beta helps in selecting funds that match investment objectives and risk tolerance, leading to more informed investment decisions.

Conclusion

Understanding and using Alpha can help you make better investment decisions when evaluating mutual funds. Alpha provides insight into a fund manager’s ability to add value beyond market movements. By incorporating Alpha into your investment strategy, you can identify mutual funds that are likely to offer superior performance.

FAQs

How does Alpha differ from other measures like Beta when evaluating mutual funds?

Alpha measures a fund's performance relative to a benchmark, indicating added value, while Beta measures a fund's volatility compared to the market.

Can Alpha provide insight into a fund manager's investment strategy?

Yes, Alpha can reveal the effectiveness of a fund manager's investment decisions by showing how much value they add beyond the market trends.

What are some common misconceptions about Alpha in mutual fund analysis?

A common misconception is that a high Alpha always means better performance. It is essential to consider Alpha in conjunction with other metrics like Beta.

Is higher Alpha always better, or are there scenarios where lower Alpha is preferable?

Higher Alpha is generally better, but it should be evaluated with other factors like risk (Beta) and the consistency of performance over time.

How reliable is Alpha as an indicator of future fund performance?

While Alpha is a useful measure, it is not a guarantee of future performance. Alpha is best used alongside other indicators to make informed investment decisions.

What level of alpha is considered good in mutual funds?

In mutual funds, a positive alpha signifies outperformance relative to the benchmark after adjusting for risk, while negative alpha indicates underperformance. It's essential to consider factors like consistency, risk-adjusted returns, and the fund manager's track record when evaluating a fund's performance.

What is the best level of alpha in mutual funds?

There is no universal "best" alpha for mutual funds, as it depends on factors like fund category, risk profile, and market conditions. Consistent positive alpha is valuable, even if small, but other metrics like Sharpe ratio, standard deviation, expense ratio, and the fund manager's experience should also be considered.

Is a higher alpha better for mutual funds?

A higher alpha is typically considered better for mutual funds, as it signals that the fund has outperformed its benchmark. However, it's important to consider the fund's risk profile, expense ratio, and consistency of performance, alongside alpha. Evaluating risk-adjusted returns and diversification is also crucial. Equally important is noting that alpha measure is based on the fund’s past performance. Past performance may or may not be sustained in the future.

Is positive or negative alpha better?

Positive alpha is generally seen as better than negative alpha, as it suggests outperformance relative to the benchmark after adjusting for risk. Consistency in positive alpha is more valuable than occasional spikes, and it's important to evaluate risk-adjusted returns and other factors like the expense ratio and the manager's experience.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.