What are the opportunities and risks of investing in emerging markets?

Emerging markets offer an attractive return potential for investors seeking growth opportunities. However, while the ability to capitalise on high GDP growth and favourable demographics can drive portfolio performance, the volatility, political uncertainty, and liquidity challenges prevalent in these markets also pose significant risks.

Hence, mutual fund investors aiming to allocate capital in emerging markets must thoroughly assess their risk tolerance and long-term objectives before pursuing promising gains accompanied by heightened uncertainties.

- Table of contents

- What are emerging markets

- Opportunities in emerging markets

- Potential benefits of investing in emerging markets

- Risks of investing in emerging markets

- Things to do before you invest

- Important considerations before investing in emerging markets

What are emerging markets

Emerging markets are countries that are in the transitioning toward more advanced stages of economic development. While definitions may vary, they typically present a distinct investment environment, Some common features are to understand what are emerging markets and emerging markets meaning:

- Faster economic expansion: These economies often record higher GDP growth rates than developed ones. This is due to industrialisation and a rising middle-income population.

- Evolving financial infrastructure: Their financial markets are still developing and may not be as liquid, regulated, or mature as those in advanced economies.

- Lower average income levels: Although growth is strong, the income per person tends to be lower than in more developed nations.

- High risk tolerance: Due to factors such as economic restructuring and currency volatility, these markets may be more unpredictable and require a high risk tolerance.

- Favourable demographics: Many of these countries have younger populations and expanding workforces, which can support long-term consumption and growth.

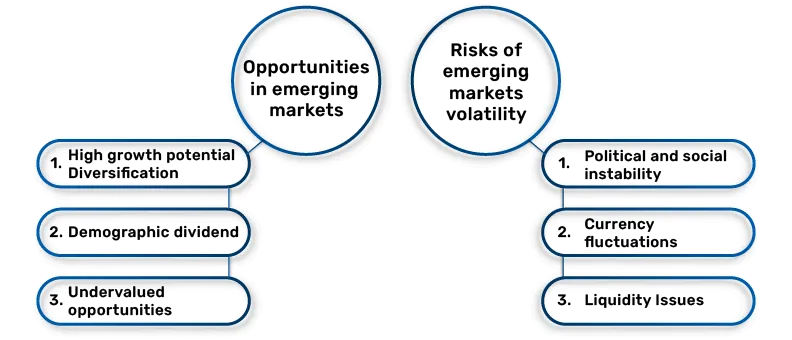

Opportunities in emerging markets

Emerging markets are economies that are progressing toward becoming more advanced, usually by rapid growth and industrialization. Such countries are considered one of the top emerging market economies. Here are some of the potential opportunities when investing in emerging markets:

- High growth potential

Strong population growth, rising incomes, urbanisation, and government reforms are driving domestic consumption. This high growth potential makes it an attractive option for mutual fund investors looking for good returns over the long run.

- Diversification

Since emerging markets often perform differently than developed markets, adding some allocation to them allows you to spread the overall portfolio risk and volatility.

- Demographic dividend

Emerging markets may have a large young population that is entering the workforce. This demographic dividend is expected to last for decades and can be a reason for continued growth. Mutual fund investments in these countries, therefore, can potentially benefit from rising productivity and domestic demand driven by this trend.

- Undervalued opportunities

Securities and assets in emerging countries are often undervalued compared to their counterparts in developed markets. This provides an opportunity for mutual funds to gain exposure to quality assets at a reasonable cost. Active fund managers can identify mispriced assets that offer a superior risk/return profile.

Potential benefits of investing in emerging markets

Following are the key potential benefits of investing in emerging market opportunities through mutual funds.

- Higher return potential over time compared to developed markets.

- Diversification and relatively reduced overall portfolio volatility.

- Access to innovative companies not available in developed markets.

- Have strong GDP growth and demographic trends.

- Undervalued assets and mispriced opportunities.

- Hedge against weakness in developed markets.

Moreover, many mutual funds provide ease of access, diversification, and active management for those looking to invest a portion of their portfolio in emerging markets.

Read Also: Investing for a long term in mutual funds: The smart investment strategy for your future

Risks of investing in emerging markets

While it seems appealing, there are also heightened risks in emerging market opportunities investment that investors should be aware of.

- Volatility: Emerging markets experience higher volatility compared to developed markets. This means investors should be prepared for potentially more extreme ups and downs in the value of their investments.

- Political and social instability: Factors like political turmoil, social unrest, weak infrastructure, can negatively impact investments in emerging markets.

- Liquidity Issues: Thin trading volumes for some assets can make entering or exiting positions difficult. Liquidity risk tends to be higher compared to developed markets.

- Opaque reporting and disclosures: Accounting standards, financial reports and disclosures made by companies in emerging markets may not be robust. This makes research and due diligence more difficult.

- Contagion effect: Emerging markets are susceptible to economic shocks and events in other countries due to global interconnectedness. For example, economic policy shifts by major economies like the United States can lead to capital outflows from emerging markets.

Read Also: Risk management techniques for small cap fund investors

Things to do before you invest

Given the unique risks, one should invest in emerging market opportunities only after proper research and added caution.

- Pick funds with experienced managers familiar with navigating emerging markets.

- Choose funds with disciplined risk management strategies.

- Diversify across geographies, sectors, and companies.

- Have a long-term investment horizon of at least 5-10 years.

- Continuously monitor your funds and the macro environment.

- Be prepared to tolerate the volatility characteristic of emerging markets.

Conclusion

Investing in emerging markets has the potential to enhance returns over the long run. However, be aware of the heightened risks and exercise due caution. Evaluate your risk tolerance, investment goals, and time horizon before investing. Maintain a well-diversified portfolio and invest in funds managed by seasoned investment professionals. Adopting prudent risk management strategies can help you successfully tap into the growth potential of emerging markets.

FAQs:

How much of my portfolio should I allocate to emerging markets?

As a rule of thumb, limit your overall exposure to emerging markets to 5-15% of your total portfolio. This allows you to tap into the growth while limiting risk.

What are the advantages of investing in emerging markets?

Investing in emerging markets offers high growth potential, as these economies are often expanding rapidly. Investors may benefit from significant returns driven by economic development and increasing consumer demand. Additionally, emerging markets can provide diversification benefits, as their performance often correlates differently with developed markets, potentially reducing overall portfolio risk.

What are the disadvantages of emerging markets?

Emerging markets can pose higher risks due to political instability, economic volatility, and less mature financial systems. Investors may face challenges like limited liquidity, less regulatory oversight, and potential currency fluctuations. These factors can lead to increased volatility and unpredictable returns, making emerging markets more complex and riskier than developed markets.

What are the challenges of emerging markets?

Emerging markets face several challenges, including political instability, economic volatility, and weaker infrastructure. Regulatory environments may be less transparent, leading to higher risks. Additionally, currency fluctuations and less-developed financial systems can create uncertainties. These factors can affect investment stability and returns, requiring careful risk management and due diligence from investors.

What is emerging markets meaning?

Emerging markets refer to countries that are transitioning from developing to developed economies.

Related Searches:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.