What is a Good P/E Ratio? Is High or Low Better?

With the growing number of digital financial platforms and tools, reviewing listed companies has become easier. One commonly used metric of analysis is the price-to-earnings (P/E) ratio. This measure helps investors understand how the market is valuing a company relative to its earnings.

This article explains the P/E ratio in detail, discusses how higher and lower P/E levels may be interpreted, and outlines how P/E ratios need to be assessed across different contexts rather than viewed in isolation.

Table of contents

- Understanding the price-to-earnings (P/E) ratio

- The P/E ratio formula

- Interpreting the P/E ratio: High vs. low

- What constitutes a ‘good’ P/E ratio?

- Industry benchmarks and context

- Company growth prospects

- Historical P/E and market sentiment

- The different types of P/E ratios

- Limitations of P/E

- Beyond P/E: Other key ratios for a complete picture

Understanding the price-to-earnings (P/E) ratio

The price-to-earnings (P/E) ratio reflects how much value the market places on a company relative to the profits it generates. In simple terms, it compares a company’s share price with its earnings per share.

To illustrate, consider a small business generating an annual profit of ₹6 lakh. If a buyer is willing to purchase this business for ₹48 lakh, the valuation reflects a multiple of eight times annual earnings. Dividing the purchase price by annual profit results in a P/E of 8, meaning the buyer is paying ₹8 for every ₹1 of annual earnings.

Example for illustrative purposes only.

The P/E ratio formula

The P/E ratio is calculated using the following formula:

P/E ratio = market price per share/earnings per share (EPS)

For example, if a listed company reports earnings per share of ₹8 and its share trades at ₹160, the P/E ratio would be 20. This indicates that investors are paying ₹20 for every ₹1 of earnings generated by the company.

Examples for illustrative purposes only.

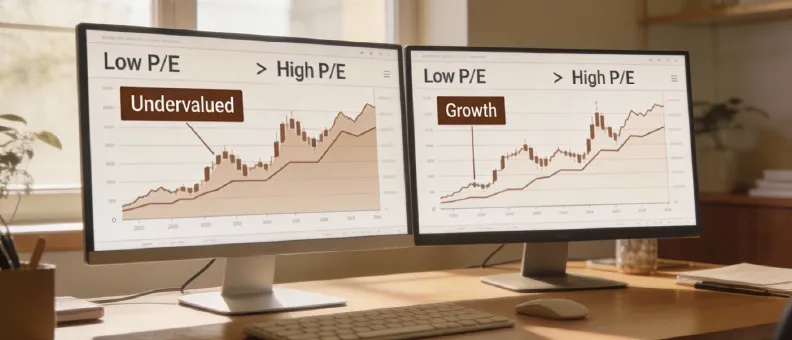

Interpreting the P/E ratio: High vs. low

High P/E companies

Companies with higher P/E ratios are often associated with stronger growth expectations. Investors may be willing to pay a higher price today based on the belief that earnings may grow over time. However, higher P/E levels are often accompanied by higher valuation risk. If earnings growth does not materialise as expected, prices may adjust, leading to increased volatility. In certain situations, higher P/E ratios may also indicate stretched valuations.

Low P/E companies

Companies with lower P/E ratios are often associated with mature or slower-growing businesses. A lower P/E may suggest that the stock is priced conservatively relative to current earnings, though it may also reflect limited growth visibility or underlying business challenges. Lower P/E stocks are sometimes observed in established industries with relatively predictable earnings, though this does not eliminate business or market risk.

What constitutes a ‘good’ P/E ratio?

Investors may wonder what a ‘good’ P/E ratio of a stock is. There is no single P/E level that may be considered suitable across all companies. P/E ratios are generally assessed in context, considering industry characteristics, market conditions, and business fundamentals.

- Higher P/E ratios may reflect stronger growth expectations but often involve higher risk.

- Lower P/E ratios may appear more conservative but could also signal structural or cyclical concerns.

Industry benchmarks and context

Different industries operate under different business models, capital requirements and growth cycles. As a result, P/E ratios vary widely across industries.

While capital-intensive industries may have lower P/E ratios due to moderate growth expectations, consumer-focused or technology-oriented sectors may trade at relatively higher P/E levels due to their perceived scalability and visibility of demand.

Company growth prospects

Growth expectations play an important role in valuation. Companies expected to potentially expand earnings over time may command higher P/E ratios. Investors often review factors such as revenue growth visibility, expansion plans, competitive positioning, and product innovation when assessing valuation levels.

Historical P/E and market sentiment

Historical valuation trends may offer useful context. If a company’s current P/E differs significantly from its long-term average, it may reflect changing market sentiment or evolving business conditions. Broader market cycles also influence valuations. During optimistic phases, market-wide P/E levels may expand, while during uncertain periods, valuations may contract.

Past performance may or may not be sustained in future.

The different types of P/E ratios

Trailing P/E ratio

The trailing P/E ratio is based on earnings from the past 12 months. It reflects how the company has performed historically and is calculated using reported earnings. A higher trailing P/E may reflect positive sentiment, while a lower trailing P/E may indicate cautious market expectations.

Forward P/E ratio

The forward P/E ratio uses estimated earnings for the next 12 months. This measure may help assess expectations around future earnings, though it relies on projections that may change over time.

Cyclically adjusted price-to-earnings (CAPE) ratio

The CAPE ratio uses average inflation-adjusted earnings over a longer period, typically ten years. It is often applied to indices rather than individual stocks and may help smooth the impact of economic cycles when assessing long-term valuation trends.

Limitations of P/E

The P/E ratio considers only share price and earnings, without accounting for leverage, cash flows, or balance sheet risk. Companies with similar P/E ratios may have very different growth profiles and financial strength. Cross-industry comparisons may also be misleading due to structural differences.

As a result, valuation analysis typically incorporates additional measures such as price-to-book ratios, return on equity, debt levels, cash flow metrics, and margin trends.

Beyond P/E: Other key ratios for a complete picture

- Price-to-Book (P/B) ratio

- Return on Equity (ROE)

- Debt-to-Equity ratio

- Cash flow indicators

FAQs

Is a higher P/E ratio always better for a stock?

No. A higher P/E ratio may reflect growth expectations but may also involve higher valuation risk.

How is Earnings Per Share (EPS) calculated for the P/E ratio?

Earnings per share is calculated by dividing a company’s profit after tax by the number of outstanding shares.

Do all companies have a meaningful P/E ratio?

No. Companies reporting losses do not have a meaningful P/E ratio.

How can I find the P/E ratio of a stock or a mutual fund portfolio?

P/E ratios are available through stock exchange data, financial platforms, and mutual fund factsheets.

What is the average P/E ratio of the Indian stock market?

Market-level P/E ratios vary over time depending on earnings growth and prevailing sentiment.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.