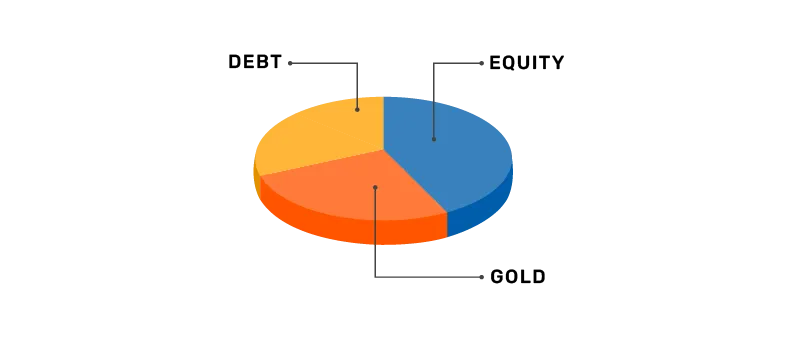

Multi Asset Allocation Funds are hybrid mutual funds that invest in at least three different asset classes—such as equity, debt, and commodities—while maintaining a minimum 10% exposure to each. By diversifying across assets that behave differently in various market conditions, these funds aim to provide a balanced investment experience with smoother returns over time. Equity offers growth potential, debt contributes stability, and commodities can help hedge against inflation or market volatility.

Bajaj Finserv Multi Asset Allocation Fund follows a dividend-yield investing strategy. which involves selecting stocks or securities that typically pay higher dividends compared to the Nifty 50 index. Such companies typically stable business models and a history of sustainable growth over time. Dividend yield is a measure of how much a company pays out in dividends relative to its stock price. By reinvesting these dividends, investors can potentially enhance opportunities for compounded growth over time.

Whether you're a seasoned investor or just starting out, Bajaj Finserv Multi Asset Allocation Fund can take you a step closer to your goals while navigating volatility and balancing risk with potential returns overtime.

You can invest via lumpsum or SIP. To decide your monthly SIP amount, you can make use of our online SIP calculator.

Bajaj Finserv Multi Asset Allocation Fund - Regular & Direct Plans

When you invest in Bajaj Finserv Multi Asset Allocation Fund, you have two plans – direct and regular. Each plan caters to different types of investors and the level of involvement they are looking for.

Direct Plan

The direct plan is designed for investors who wish to invest independently, without the help of a distributor. Since there is no commission involved, the expense ratio is often lower. This means that this can lead to potentially better net returns in the long run.

Regular Plan

In the regular plan, investors invest through a mutual fund distributor who guides them through the whole process. Here a commission is involved hence the expense ratio runs slightly higher. However, this plan comes with its own potential advantages like personalized advice, goal-based recommendations and on-going support with transactions like purchases and redemptions.

How to invest in Bajaj Finserv Multi Asset Allocation Fund

To invest in the Bajaj Finserv Multi Asset Allocation Fund, you have two options at your disposal.

If you're investing through a distributor, they will provide you with the application form, assist you in filling it out, and submit it on your behalf. Alternatively, if you wish to invest directly with the AMC, you can fill out the form yourself and submit it at any of the AMC’s official Points of Acceptance.

You can invest using your demat or online trading account. Another option is to visit the Bajaj Finserv AMC investor portal, create an online account, and complete your investment in just a few steps.

Taxation on Bajaj Finserv Multi Asset Allocation Fund

As Bajaj Finserv Multi Asset Allocation Fund is equity-oriented, it follows the taxation rules that are applied to all equity schemes.

Short-term capital gains (STCG):If you redeem your investment within one year, the gains are taxed at 20%, plus applicable surcharge and cess.

Long-term capital gains (LTCG):If you stay invested for over a year, gains up to ₹1.25 lakh in a financial year are exempt from tax. Any gains beyond that are taxed at 12.5%, along with surcharge and cess as applicable.

Please consult your tax advisor for personalised advice. Tax laws are subject to change.

Explore Related Hybrid Funds

Explore All Schemes