Core and Satellite Portfolio: Meaning & Approaches

Investors often seek a portfolio structure that offers relative stability over the long term while still allowing exposure to growth opportunities. The way investments are arranged within a portfolio may affect how it responds to different market conditions over time.

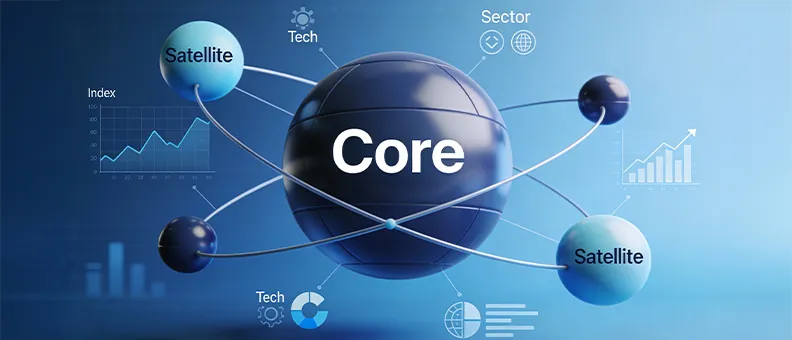

One commonly discussed portfolio construction framework is the core and satellite portfolio approach. Instead of relying on a single investment style, this approach involves dividing investments into two broad components: one intended to provide relatively consistent market participation, and another designed to allow selective exposure to higher-risk ideas over the long term.

This article explains the concept, outlines commonly discussed strategies, and highlights practical considerations related to the core and satellite portfolio approach.

Table of contents

- What is the core and satellite portfolio strategy?

- Understanding the ‘core’ of your investment portfolio

- Exploring the ‘satellite’ component for growth

- Why implement the core and satellite strategy?

- Who should consider the core and satellite strategy?

- Maintaining and rebalancing your core and satellite portfolio

What is the core and satellite portfolio strategy?

A core and satellite portfolio refers to a portfolio structure in which the total investment is divided into two broad components:

- Core: This typically represents the larger portion of the portfolio and is intended to provide long-term participation in markets with relatively lower volatility when compared with more concentrated equity strategies.

- Satellite: This represents a smaller portion of the portfolio and is used to gain selective exposure to specific themes, sectors, or market segments that may offer higher return potential over the long term, along with higher volatility.

The core and satellite portfolio approach is a method of portfolio construction rather than a financial product. It focuses on asset allocation and diversification rather than short-term market movements. This approach does not eliminate risk – even the core portfolio remains subject to market risk – and outcomes may vary based on market conditions, scheme selection, costs, and investor behaviour.

Understanding the ‘core’ of your investment portfolio

The core component is often illustrated using diversified equity-oriented strategies such as large cap funds or index-tracking funds, including Exchange Traded Funds (ETFs). Since such schemes aim to track broad market indices like the Nifty 50 or the BSE Sensex, they may form a relatively consistent foundation for the portfolio over the long term.

These schemes typically provide broad market exposure and may involve relatively lower portfolio turnover. However, as equity-oriented investments, they are classified as very high risk and remain subject to market volatility. A major portion of the portfolio, such as 60% to 80%, is often allocated to the core component by some investors.

In some portfolios, particularly for investors with lower risk tolerance or shorter time horizons, the core component may also include debt-oriented or hybrid mutual funds. Such funds may help moderate overall portfolio volatility and provide relatively steadier return profiles, depending on their structure and underlying assets. The composition of the core is therefore influenced by the investor’s goals, risk profile, and stage of the investment journey.

Exploring the ‘satellite’ component for growth

The satellite component is generally used for more active or focused strategies. This portion may include sectoral funds, thematic funds, mid cap funds, small cap funds, or other equity-oriented categories with relatively higher volatility and return potential over the long term. Sectoral and thematic funds are more concentrated in nature and may carry higher risk compared to diversified equity funds. Some investors consider them for tactical allocation in the satellite portfolio.

Satellite allocations are typically smaller in proportion, often illustrated as 20% to 40% of the overall portfolio. The intention is to limit the impact of higher volatility at the portfolio level while allowing exposure to specific segments that may offer potential growth opportunities over time.

Also Read: How to Build a Mutual Fund Portfolio

Why implement the core and satellite strategy?

Balancing risk and reward for optimal performance

In mutual fund investing, potential returns and potential risks are generally linked. Equity-oriented strategies with higher return potential over the long term may also experience higher volatility. The core and satellite framework is designed to structure this relationship through allocation, with the core aiming for relatively consistent market participation and the satellite introducing measured exposure to higher-volatility segments.

Enhancing diversification across asset classes

Diversification remains an important principle in portfolio construction. A core and satellite structure supports diversification by separating foundational allocations from more focused exposures. The core may contribute to relative consistency over time, while satellite components may introduce controlled variation within the portfolio.

Flexibility to respond to market opportunities

Markets evolve due to economic cycles, policy changes, and global developments. A core and satellite portfolio may offer a structured way to adjust selective exposures without materially altering the long-term foundation of the portfolio.

Who should consider the core and satellite strategy?

The core and satellite approach is discussed across a wide range of investor profiles, though its suitability may vary significantly. Here are some investors who may consider it:

- Investors with a long-term investment horizon:

The core and satellite approach is often discussed in the context of long-term investing, where the core component aims to provide broad market exposure while satellite allocations are used selectively over time. - Those seeking balance between stability and flexibility:

Investors who prefer a relatively stable portfolio foundation but also want the flexibility to explore specific themes, sectors, or strategies may find this framework useful. - Investors comfortable with periodic portfolio review:

The approach typically requires ongoing monitoring and rebalancing to ensure that satellite allocations remain aligned with risk tolerance and overall portfolio objectives. - Individuals with a clear understanding of risk:

Since satellite investments may involve higher volatility, this approach may be more suitable for investors who understand the potential risks and are comfortable with short-term fluctuations. - Goal-oriented investors:

Investors who align their portfolios with defined financial goals may use the core component to anchor long-term objectives, while satellites are adjusted based on evolving market conditions or opportunities.

Read Also: How to Rebalance Your Portfolio with Small Cap Funds?

Maintaining and rebalancing your core and satellite portfolio

Over time, market movements may cause portfolio allocations to drift from their original structure. Rebalancing involves periodically reviewing and adjusting allocations to bring them back in line with intended levels. Investors may assess their portfolios at regular intervals, such as once every six to twelve months, to evaluate alignment with financial goals and changing personal circumstances.

Conclusion

The core and satellite portfolio approach focuses on disciplined portfolio construction rather than short-term market timing. By dividing investments into a relatively consistent core and selective satellite exposures, investors may seek to structure their portfolios in a manner that balances long-term participation with flexibility, while remaining subject to market risks.

FAQs

What percentage should my core and satellite allocations be?

Allocations may vary based on individual investor profiles. Some investors may prefer a relatively higher allocation to core investments, while others may choose a higher satellite component, depending on goals and risk tolerance.

Can I use Bajaj Finserv AMC’s ETFs or index funds as part of my core portfolio?

Index funds and ETFs, especially those tracking large cap indices, are commonly discussed as part of core allocations as they entail relatively lower costs and offer diversified market exposure, although they remain subject to equity market risks.

Bajaj Finserv AMC offers various index funds and ETFs, which investors may consider for their portfolio after evaluating their risk appetite, goals, investment horizon and overall suitability. It may also be helpful to consult a financial advisor. You can view the list of index funds here and ETFs here.

How often should I rebalance my core and satellite portfolio?

Investors may review their portfolios periodically, such as once every six to twelve months, to assess whether allocations continue to align with financial goals.

Is the core and satellite strategy suitable for beginners?

Beginners may explore this approach after developing an understanding of basic investment principles and considering guidance from a registered investment adviser or an AMFI-registered distributor.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.