Factor-based funds: What are they, and should you invest in them?

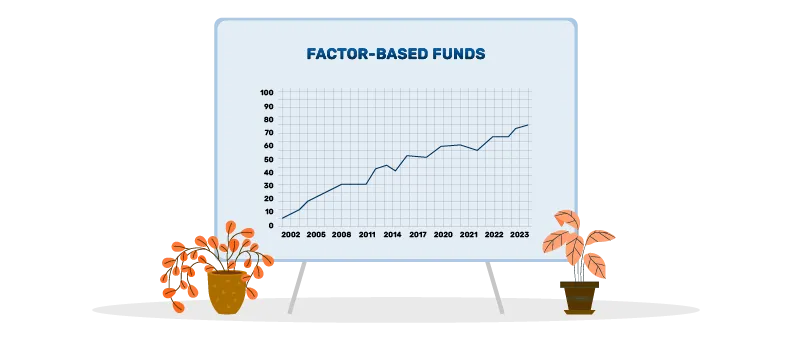

When it comes to investing to grow your wealth, there are many options to choose from. However, one type of investment avenue that is gaining popularity in India is the factor-based fund. But what are factor-based funds, and should you consider investing in them?

This article will help you understand factor-based funds, their benefits, whether they are a suitable choice for you, and how you can invest in them.

- Table of contents

- Understanding Factor-Based Investing

- Factors Driving Factor-Based Funds

- Benefits of Factor-Based Funds

- How to Invest in Factor-Based Funds

Understanding Factor-Based Investing

Actively managed equity mutual funds typically design their portfolios based on categories provided by SEBI, requiring investments in certain market capitalizations of companies and other parameters. Passive funds such as traditional index funds and exchange-traded funds (ETFs) often follow a broad market index or specific sector.

In contrast, factor-based funds select investments based on specific characteristics or “factors” that can affect a stock’s performance. Common factors include value, momentum, quality, and volatility. For example, a value factor fund focuses on stocks that appear undervalued compared to their fundamentals, while a momentum factor targets stocks that have shown strong recent performance.

Factors Driving Factor-Based Funds

There are several key factors that drive the creation and management of factor-based funds. Some of the most common factors are the following:

- Value: Investing in stocks that are undervalued compared to their intrinsic value.

- Momentum: Choosing stocks that have been performing well in the recent past in the hope of riding this momentum.

- Quality: Focusing on companies with strong financial health and stable earnings.

- Volatility: Investing in stocks with lower price fluctuations for more stability.

- Growth: Investing in stocks of companies that are expected to offer above-average growth potential.

Benefits of Factor-Based Funds

Factor-based funds offer several benefits to investors. Here are a few key advantages:

- Diversification: By targeting specific factors, these funds can provide diversification beyond traditional market indices.

- Risk management: Factors like low volatility can help reduce the overall risk of the portfolio.

- Potential for higher returns: Factors such as value, growth, or momentum have the potential to outperform the overall market performance over the long term.

- Customisation: Investors can choose funds that align with their investment goals and risk tolerance by selecting factors that match their preferences and the investment style that appeals to them.

- Cost efficiency: Factor-based index funds or ETFs may have lower fees compared to actively managed funds while providing the potential for market-beating returns.

How to Invest in Factor-Based Funds

Investing in factor-based funds is relatively simple. You can follow these steps to invest in factor-based funds:

- Research: Begin by understanding the different factors and how they align with your investment goals and the investment style that interests you.

- Choose a fund: Look for factor-based funds offered by reputable investment companies. Check their track record, fees, and the specific factors they target.

- Open an account: You can invest in these funds through a brokerage account or through the asset management company, an aggregator, or a distributor.

- Monitor performance: Regularly review your investment to ensure it continues to meet your objectives. Keep an eye on how the factors are performing in the current market environment.

- Stay informed: Stay updated with market trends and any changes in the factors you are investing in.

Conclusion

Factor-based funds offer a unique approach to investing by focusing on specific characteristics that can drive performance. They provide benefits like diversification, risk management, and the potential for higher returns. While they can be suitable for many investors, it is essential to research and choose funds that align with your investment goals and risk tolerance.

FAQs

How do factor-based funds differ from traditional mutual funds or ETFs?

Factor-based funds use specific characteristics, or factors, to select investments, while traditional mutual funds or ETFs typically follow a broad market index or sector.

Are factor-based funds suitable for all types of investors?

While they can be suitable for investors, it is crucial to understand the parameters used for stock selection and ensure that it aligns with your investment goals and risk tolerance. For example, some investors may prefer the growth investing style, while others may prefer value or momentum investing.

How do I assess the performance of factor-based funds?

Evaluate their performance by comparing them to relevant benchmarks and reviewing their historical returns, fees, and the performance of the targeted factors.

What are some common mistakes to avoid when investing in factor-based funds?

Avoid common mistakes like not researching the factors and not aligning the fund's strategy with your risk appetite and investment goals.

How does market volatility affect factor-based funds?

Market volatility can impact factor-based funds differently depending on the factors they target. For example, funds focusing on low volatility may perform better during turbulent times. Growth funds may be very susceptible to volatility.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Related Searches:

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

The content herein has been prepared on the basis of publicly available information believed to be reliable. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, assure its completeness or warrant such information will not be changed. The tax information (if any) in this article is based on prevailing laws at the time of publishing the article and is subject to change. Please consult a tax professional or refer to the latest regulations for up-to-date information.