Nimesh Chandan has over 24 years of experience in the Indian Capital Markets. He has spent 18 years in Fund Management- managing and advising domestic and international investors, retail as well as institutional. Prior to joining Bajaj Finserv Asset Management Ltd., he has worked with Canara Robeco Asset Management as Head of Investments, Equities (Domestic and Offshore). He has also worked with other asset management companies including Birla Sunlife Asset Management, SBI Asset Management and ICICI Prudential Asset Management.

{

"debt": "Debt/Cash 100%",

"equity": "Equity 0%",

"ONRGG": {

"nav": "10000",

"date": "31-12-2025",

"since": {

"bajajflexi": "6.33",

"bajajsmall": "6.39",

"bajajnifty": "6.82"

},

"6_month_ago": {

"bajajflexi": "5.81",

"bajajsmall": "5.81",

"bajajnifty": "6.26"

}

},

"ONDGG": {

"nav": "10001",

"date": "31-12-2025",

"since": {

"bajajflexi": "6.38",

"bajajsmall": "6.39",

"bajajnifty": "6.82"

},

"6_month_ago": {

"bajajflexi": "5.86",

"bajajsmall": "5.81",

"bajajnifty": "6.26"

}

}

}

Bajaj Finserv Overnight Fund

Debt

Regular Growth

Direct Growth

| NAV | Risk Type |

|---|---|

|

|

Low

|

For -

Since Inception

1 Year

As on 30-09-2024

Bajaj Finserv Overnight Fund

26.48%

CRISIL Liquid Overnight Index

15.83%

CRISIL 1 Year T-Bill Index

15.83%

Total AUM

₹915.69 crores

as on 31-12-2025

Benchmark

CRISIL Liquid Overnight Index

Min. SIP Amount

₹1000

Inception Date

05-07-2023

Benefits of investing in Bajaj Finserv Overnight Fund

Relatively stable returns

Overnight funds offer relatively stable returns to investors that may be marginally higher than the returns provided by a savings account.

Insta redemption

Bajaj Finserv Overnight Fund offers insta redemption, where up to Rs.50,000 or 90% of your balance, whichever is lesser, can be redeemed instantly.

Suitability for short-term goals

Overnight funds may be suitable for short-term financial goals like parking surplus funds or meeting short-term financial obligations.

Investment Objective

The scheme aims to provide reasonable returns commensurate with low risk and high level of liquidity through investments made primarily in overnight securities having maturity of 1 business day.

However, there is no assurance that the investment objective of the Scheme will be achieved.

About the Bajaj Finserv Overnight Fund

Bajaj Finserv Overnight Fund is an open-ended scheme investing in debt, money market instruments and cash and cash equivalents with a maturity of one day. The very short maturity of the underlying securities can mitigate the interest and credit rate risk of the fund while providing high liquidity.

The Bajaj Finserv Overnight Fund may be suitable for investors with idle cash who want an avenue that can potentially offer better returns than a current account, or corporates who want to park surplus funds overnight. Investors looking for a short-term and liquid investment avenue with the potential to offer reasonable returns at relatively low risk can consider investing in Bajaj Finserv Overnight Fund.

Asset Allocation Pattern

Instruments - Debt (Including floating rate debt instruments) and money market instruments Indicative allocations - Maximum=100%, Minimum= 0%.

Risk profile - Low to moderate

Risk profile - Low to moderate

Portfolio - Current Allocation

Top Holding

Top Holding

Top Holdings

No Data to Display

Allocation by Market Cap

No Data to Display

Top Sectors

No Data to Display

As on 31-12-2025

Top Holdings

Reverse Repo / TREPS

90.70%

364 Days Tbill (MD 01/01/2026)

5.18%

182 Days Tbill (MD 22/01/2026)

2.07%

Instrument break-up

See All Holdings

As on 31-12-2025

Historical Returns (as per SEBI format) As on 31-12-2025

| Tenors | CAGR | Current value of ₹10,000 Invested | ||

|---|---|---|---|---|

| Since Inception | 1Y | Since Inception | 1Y | |

| Bajaj Finserv Overnight Fund | 6.33% | 5.81% | 11,653 | 10,581 |

| CRISIL Liquid Overnight Index | 6.39% | 5.81% | 11,669 | 10,581 |

| CRISIL 1 Year T-Bill Index | 6.82% | 6.26% | 11,787 | 10,626 |

Disclaimer: Past performance may or may not be sustained in future.

Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Performance is provided for Regular Plan - Growth Option. Inception Date: 5th July 2023 Period for which scheme's performance has been provided is computed basis last day of the previous month preceding the date of this material.

Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized.

Portfolio Parameters As on 31-12-2025

| YTM

|

5.72% |

| Average Maturity

|

2 Day |

| Macaulay Duration

|

2 Day |

| Modified Duration

|

1 Day |

YTM details should not be construed as indicative returns and the securities bought by the Fund may or may not be held till the respective maturities.

Who Should Invest?

- Institutions that want to park surplus funds overnight

- Investors with idle cash looking to generate returns over and above current account

Fund Managers

Fund Details

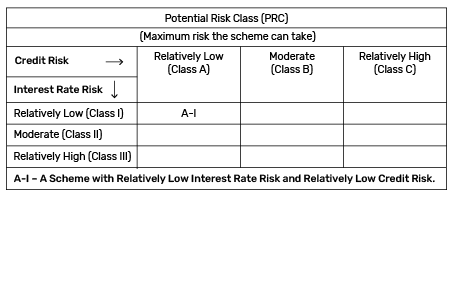

Type of Scheme

An open ended debt scheme investing in overnight securities with relatively low interest rate risk and relatively low credit risk.

Minimum Application Amount

- Fresh Purchase (Incl. Switch-in): Minimum of Rs. 100/- and in multiples of Re. 1/- thereafter.

Load Structure/Lock-In Period

Entry load - Not applicable

Exit load - Nil

Potential Risk Class (PRC)

- The PRC matrix identifies the highest amount of potential risk that a debt mutual fund can assume.

- This regulation was implemented by SEBI on December 1, 2021, making it essential for fund houses to categorize all new and existing schemes under a potential risk class (PRC) matrix.

Product Label and Riskometer

This product is suitable for investors who are seeking*:

- Regular income over short term that may be in line with the overnight call rates.

- Investment in money market and debt instruments with overnight maturity.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Overnight Funds: Overview

Overnight funds are open-ended schemes investing in securities that mature in just one day. This could include overnight debt instruments such as reverse repos and other short-term money market assets. Because the underlying investments mature daily, overnight funds generally carry minimal interest rate risk and low credit risk compared with other debt funds.

The main objective of an overnight fund is to offer a relatively stable and highly liquid option for parking money for extremely short periods—sometimes even for a single day. They are often used by investors or institutions looking to temporarily hold surplus cash without exposing it to significant market fluctuations.

Bajaj Finserv Overnight Fund - Regular and Direct Plans

When investing in the Bajaj Finserv Overnight Fund, you can choose between a Direct Plan and a Regular Plan.

Regular Plan

In this plan, investments are made through a distributor who provides assistance with scheme selection and the transaction process. Since the fund includes distributor commissions, the expense ratio is relatively higher. However, the support from a distributor can help investors align their investment choices with their financial goals and risk profile. The application process and subsequent investments and redemptions are also handled by the distributor on the investor’s behalf.

Direct Plan

This option may be suitable for investors who prefer to manage their investments independently, without distributor involvement. The expense ratio for direct plans tends to be lower. Over time, this lower cost structure may contribute to slightly better potential net returns.

How to invest in Bajaj Finserv Overnight Fund

You can invest in the Bajaj Finserv Overnight Fund through both online and offline modes.

-

Offline Mode: If you're investing via a distributor, they will provide the necessary application form, help you fill it, and submit it on your behalf. Alternatively, you can invest directly with the AMC by submitting the filled application at an official point of acceptance.

-

Online Mode: You can invest using your Demat or online trading account. You also have the option to visit the Bajaj Finserv AMC investor portal, create an account, and complete your investment through a simple and secure transaction process.

Taxation on Bajaj Finserv Overnight Fund

The Bajaj Finserv Overnight Fund is subject to the current tax rules for debt mutual funds. For investments made on or after April 1, 2023, any capital gains, irrespective of how long you stay invested, are taxed as per your applicable income tax slab.

As a result, there is no separate treatment for short-term or long-term capital gains , and indexation benefits do not apply. Investors are advised to consider their income tax slab and consult a financial advisor to assess how taxation may influence their overall returns.

Explore Related Debt Funds

| Liquid Fund | Money Market Fund |

|---|---|

| Gilt Mutual Fund | Banking & PSU Fund |

Explore All Schemes

| Equity Funds | Debt Funds | Hybrid Funds | Index Funds |

|---|---|---|---|

| Exchange Traded Fund Funds | Savings Plus | All Mutual Funds |

Frequently Asked Questions

Bajaj Finserv Overnight Fund aims to generate income by investing in debt, money market instruments, and cash and cash equivalent with overnight maturity. Since the securities in these funds mature the next day, these funds are not exposed to the kind of interest rate risk or default risk like the rest of the debt funds. Investing in Bajaj Finserv Overnight Fund can help meet the needs of the investors who want to deploy their funds for a very short period.

Easy access to funds, suitability for short-term goals, relatively stable returns, high liquidity, and comparatively low risk are some of the benefits of investing in Bajaj Finserv Overnight Fund.

Bajaj Finserv Overnight Fund can be a suitable option for investors who are seeking regular income over short term that may be in line with the overnight call rates. Also, investors who are looking to invest in money market and debt instruments with overnight maturity can consider investing in this scheme. Investors should consult their financial advisor in case of any queries.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

It is an open-ended debt mutual fund that primarily invests in Overnight securities or debt / money market instrument* maturing on or before the next business day. The fund seeks to offer reasonable returns with a high degree of liquidity and relatively low-interest rate risk.

*TREPS, Government Repo / Reverse Repo (in Government Securities), Treasury bills, Government securities (Issued by both Central and State governments) and any other like instruments as specified by the Reserve Bank of India from time to time and approved by SEBI from time to time having maturity of 1 business day.

Investments can be made online through Bajaj Finserv AMC’s investor portal or your trading account. To invest offline, you can fill out the application form and submit to any official point of acceptance of the AMC.

The Net Asset Value (NAV) is calculated at the end of every business day daily. You can check the lates NAV it at the top of this page.

The fund’s risk classification is based on the portfolio composition as well as SEBI guidelines and is subject to periodic review. Refer to the Riskometer on this scheme page and latest documents for the current risk level.

The Assets Under Management (AUM) changes depending on market conditions and investor activity and is disclosed periodically by the AMC. For the latest AUM, check the monthly Factsheet.

The holdings may shift in response to market conditions and fund manager decisions. For the latest holdings, please refer to the monthly Factsheet.

The fund invests predominantly in Overnight securities or debt / money market instrument* maturing on or before the next business day. For more details on the asset allocation, please check the Scheme Information Document .

While the fund aims to offer the potential for relatively stable returns, they are not guaranteed and depend on market conditions.

There is no lock-in period. However, investors are advised to review the scheme-related documents for any applicable exit load or other conditions.

The expense ratio is reviewed periodically and can change. For the latest expense ratio, see the fund’s factsheet or the Total Expense Ratio section on the website.

Learn About Mutual Funds

Posted On: 06 November 2023

An overnight fund is a type of debt mutual fund that primarily invests in securities…

Posted On: 02 January 2024

Overnight funds have become increasingly popular, especially among conservative investors who prioritise relative stability and…

Posted On: 09 February 2024

For many salaried professionals, managing finances effectively is a challenge as well as a key…

Related Video

Mutual Funds For Beginners - Mutual Fund Kya Hai Aur Kaise Kaam Karta Hai

Posted On: 22 Sep 2025

What Is Top Up In Mutual Fund SIP

Posted On: 24 Sep 2025

Common Mistakes Investors Make While Watching The Market Closely

Posted On: 14 Oct 2023