Invest a fixed amount at regular intervals

Work towards long-term goals like retirement or other significant future expenses

You may build wealth over time with the power of compounding

Returns are not fixed; they depend on market conditions and fund performance

Equity funds are those mutual funds that invest predominantly in equity and equity related instruments... Know More

These funds invest in fixed income instruments, such as Corporate and Government... Know More

Hybrid mutual funds are diversified investment vehicles that invest in both equity and debt securities.... Know More

An index fund is a type of mutual fund that tracks the performance of a market index, like the Nifty 50 or BSE Sensex... Know More

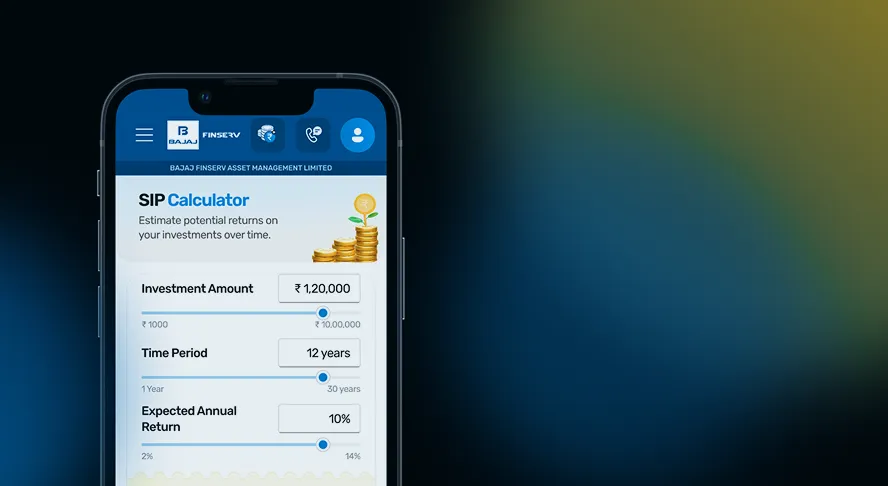

A monthly investment of Rs. 30,000 for 10 years results in a total investment of Rs. 36 lakh. Assuming an average annual return of 12%, the estimated corpus may be around Rs. 67 lakh. This is for illustrative purpose only.

Many mutual fund schemes allow investors to modify SIP amounts by registering a new SIP or using step-up or reduction options, subject to scheme rules.

Tax treatment depends on the type of mutual fund selected and the holding period. Equity and debt funds have different tax implications under prevailing tax laws.

Market volatility may impact short-term returns. However, SIPs invest at different market levels, which may help average costs over time.

A Rs. 30,000 SIP may suit individuals with stable income and long-term financial goals. Suitability depends on personal financial capacity and risk tolerance.

Call, chat or write to us if you need investment help

Toll-free number

1800-309-3900Investor WhatsApp channel

8007736666Write to us at

service@bajajamc.comShare your details and our

experts will guide you.

By submitting, I agree to receive a call from Bajaj Finserv AMC for assistance.