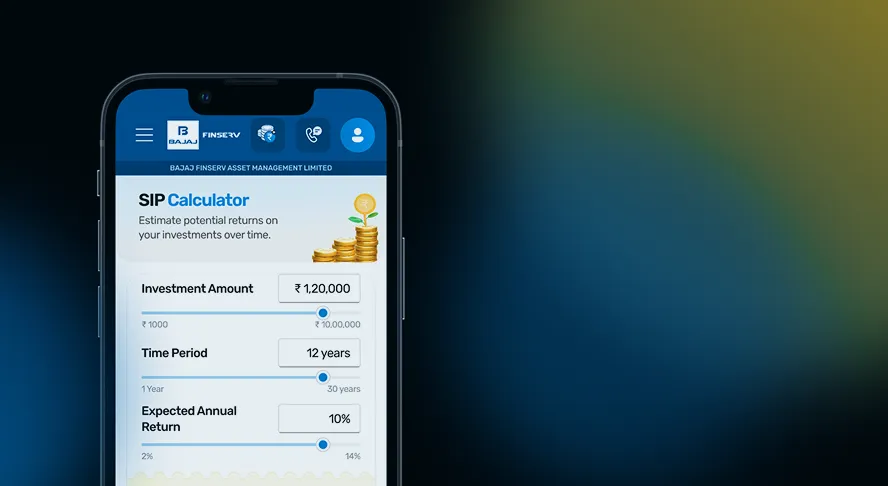

Invest Rs. 20,000 every month in a disciplined manner.

Investment period of 10 years allows participation across market cycles.

Option to increase, pause, or stop the SIP based on financial needs.

Returns depend on mutual fund performance and market conditions, not fixed interest rates.

Equity funds are those mutual funds that invest predominantly in equity and equity related instruments... Know More

These funds invest in fixed income instruments, such as Corporate and Government... Know More

Hybrid mutual funds are diversified investment vehicles that invest in both equity and debt securities.... Know More

An index fund is a type of mutual fund that tracks the performance of a market index, like the Nifty 50 or BSE Sensex... Know More

You may consider equity or hybrid mutual funds based on your risk profile and long-term goals.

No. Tax depends on the fund type and applicable capital gains rules.

A SIP offers market-linked growth potential, while an FD provides predictable returns. The choice depends on risk appetite.

Returns on fixed deposits/savings accounts are fixed, however, returns on mutual funds are subject to market risks.

No. Mutual fund investments are subject to market risks, though long-term investing may help manage volatility.

Yes. You can opt for a step-up SIP to increase the amount over time.

Yes. Most SIPs can be paused or stopped, but early exit may affect the final corpus.

No. Returns are market-linked and not guaranteed.

Types of SIP funds suitable for 10-year horizon

For a 10-year SIP, equity-oriented funds such as large cap, flexi cap, mid cap, and multi cap funds may be considered for long-term growth potential. Hybrid funds may suit investors seeking a balance between growth and relative stability. Fund selection should align with risk appetite and investment goals.

Examples of Rs. 20,000 SIP for 10 years

| Fund category | Monthly investment | Total invested | Assumed ROI (annualised) | Final amount* |

|---|---|---|---|---|

| Large Cap | Rs. 20,000 | Rs. 24,00,000 | 10% | ~Rs. 41 lakh |

| Flexi Cap | Rs. 20,000 | Rs. 24,00,000 | 11% | ~Rs. 43 lakh |

| Mid Cap | Rs. 20,000 | Rs. 24,00,000 | 12% | ~Rs. 46 lakh |

| Small Cap | Rs. 20,000 | Rs. 24,00,000 | 13% | ~Rs. 49 lakh |

Note: This is for illustration purposes only. This example uses an assumed return rate. Mutual fund returns are not guaranteed and can fluctuate based on market trends. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Call, chat or write to us if you need investment help

Toll-free number

1800-309-3900Investor WhatsApp channel

8007736666Write to us at

service@bajajamc.comShare your details and our

experts will guide you.

By submitting, I agree to receive a call from Bajaj Finserv AMC for assistance.