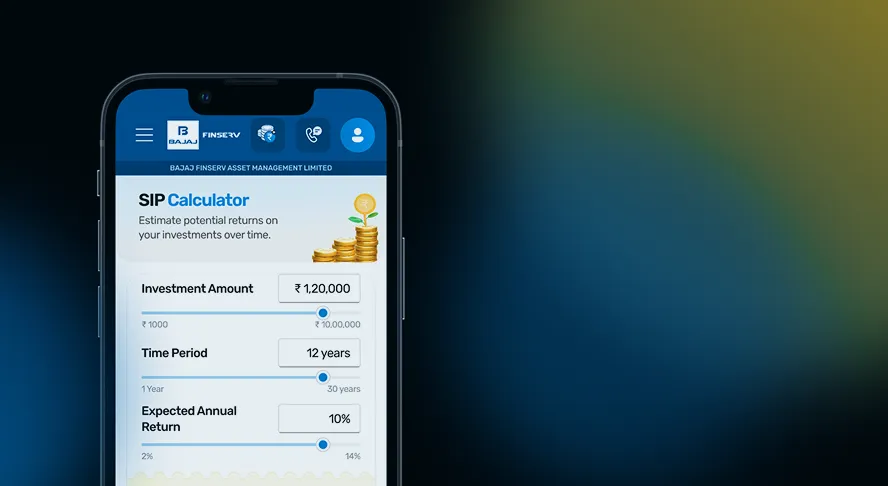

Invest a fixed amount every month.

Commitment lasts just 12 months.

Option to stop the SIP after a year.

Returns depend on fund performance, not fixed interest rates.

Equity funds are those mutual funds that invest predominantly in equity and equity related instruments... Know More

These funds invest in fixed income instruments, such as Corporate and Government... Know More

Hybrid mutual funds are diversified investment vehicles that invest in both equity and debt securities.... Know More

An index fund is a type of mutual fund that tracks the performance of a market index, like the Nifty 50 or BSE Sensex... Know More

Debt or hybrid funds may exhibit relatively lower volatility. Scheme documents provide fund details and historical performance.

No. SIPs are taxed according to fund type and holding period.

SIPs are market-linked; FDs offer fixed returns. Choice depends on risk profile and expected outcomes. Returns on fixed deposits are fixed, however, returns on mutual funds are subject to market risks.

SIPs are subject to market fluctuations. Returns are not guaranteed.

Minimum contributions can start from Rs. 500/month. Requirements differ across funds.

Some funds allow contribution changes. Check scheme documents.

SIPs can be paused or stopped per fund rules. Charges may apply as per scheme documents.

No SIP guarantees specific returns. Past performance may not continue.

Some equity funds may have recorded high returns, but past performance is not indicative of future results.

How do 1-year SIP plans work?

To start a 1-year SIP, first pick a fund that aligns with your goal and risk comfort, and decide on the monthly contribution you wish to invest. Continue investing for 12 months, after which you may redeem the units. For example, investing Rs. 3,000 per month in a Flexi Cap Fund for 12 months means a total investment of Rs. 36,000. The final value may be slightly higher or lower depending on market movements. For illustrative purpose only.

Types of SIP Funds Suitable for 1-Year Horizon

For a 1-year SIP, debt funds may be potentially more stable and suitable for short-term investing. They focus on fixed-income instruments, which generally experience lower volatility compared to equity-heavy funds. Choosing a debt fund can help align your investment with short-term goals while potentially reducing the impact of market fluctuations.

Examples of SIP for 1 Year

| Fund Category | Monthly Investment | Total Invested | Assumed ROI (Annualised) | Final Amount* |

|---|---|---|---|---|

| Large Cap | Rs. 5,000 | Rs. 60,000 | 8% | ~Rs. 62,500 |

| Flexi Cap | Rs. 5,000 | Rs. 60,000 | 10% | ~Rs. 63,000 |

| Mid Cap | Rs. 5,000 | Rs. 60,000 | 12% | ~Rs. 64,000 |

| Small Cap | Rs. 5,000 | Rs. 60,000 | 13% | ~Rs. 65,000 |

*Note: This is for illustration purposes only. This example uses an assumed return rate. Mutual fund returns are not guaranteed and can fluctuate based on market trends. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Disclaimer: The calculator alone is not sufficient and shouldn't be used for the development or implementation of an investment strategy. This tool is created to explain basic financial / investment related concepts to investors. The tool is created for helping the investor take an informed investment decision and is not an investment process in itself. Bajaj Finserv AMC has tied up with AdvisorKhoj for integrating the calculator to the website. Mutual Fund does not provide guaranteed returns. Also, there is no assurance about the accuracy of the calculator. Past performance may or may not be sustained in future, and the same may not provide a basis for comparison with other investments. Investors are advised to seek professional advice from financial, tax and legal advisor before investing in mutual funds.

Call, chat or write to us if you need investment help

Toll-free number

1800-309-3900Investor WhatsApp channel

8007736666Write to us at

service@bajajamc.comShare your details and our

experts will guide you.

By submitting, I agree to receive a call from Bajaj Finserv AMC for assistance.